Tesla Q3 2025 Earnings Preview: Record Vehicle Deliveries Amid Profit Challenges

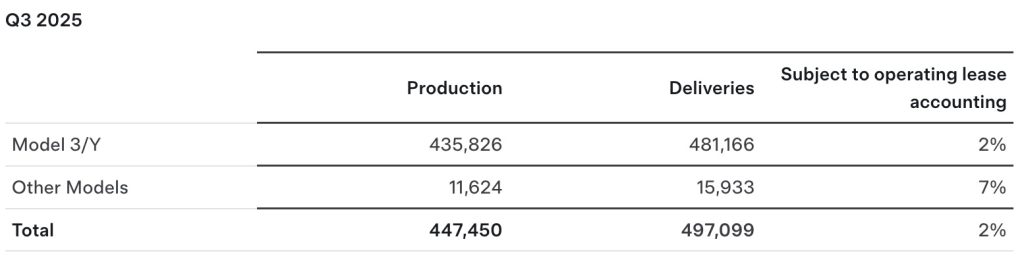

Tesla is set to announce its Q3 2025 earnings, with record vehicle deliveries expected to reach approximately 497,099 units, signaling a strong recovery in production and sales. Revenue is projected to rise 4% year-over-year to about $26.26 billion, but net profits may decline by 24% to around $1.89 billion due to aggressive global price cuts impacting automotive gross margins. Alongside financial results, Tesla's focus on advanced technologies like Robotaxi deployment, Full Self-Driving, and the Optimus humanoid robot will be highlighted as key drivers for long-term growth. Despite profitability challenges, investor confidence remains high, supported by CEO Elon Musk’s leadership and Tesla’s strategic innovation roadmap.

Summary

Tesla Q3 2025 Earnings Preview: Record Deliveries Amid Profitability Challenges

Tesla is poised to announce its Q3 2025 earnings, with expectations of record quarterly vehicle deliveries around 497,099 units. This marks a significant recovery in production and sales momentum for the electric vehicle giant. Alongside strong vehicle output, continued growth in energy storage deployment is anticipated, although exact figures have yet to be confirmed. As the market awaits the official report, analysts highlight a complex financial landscape shaped by revenue growth alongside pressured profitability.

Financial Performance: Revenue Growth vs. Profit Decline

Analysts forecast Tesla’s Q3 2025 revenue to reach approximately $26.26 billion, representing a 4% increase year-over-year. However, net profits are expected to decline sharply by 24% to roughly $1.89 billion. This divergence is largely due to Tesla’s aggressive global price cuts aimed at sustaining vehicle demand amid intensifying competition. While higher delivery volumes typically support earnings growth, the impact of these price reductions is eroding automotive gross margins, creating challenges for profitability despite record sales.

The company’s pricing strategy has drawn investor scrutiny, especially in light of the U.S. federal EV tax credits partially offsetting the effect of price cuts. Questions remain about whether Tesla has established a sustainable pricing equilibrium or if further concessions are necessary to maintain market share against growing automotive competition.

Strategic Pivot to AI, Robotics, and Autonomous Driving

Beyond financial metrics, Tesla’s Q3 earnings call and shareholder meeting are expected to emphasize the company’s strategic investment in advanced technologies. Tesla continues to position itself at the forefront of artificial intelligence and robotics innovation, focusing on several key initiatives:

- Robotaxi Commercial Deployment: Investors are closely tracking progress toward launching a fully commercial Robotaxi service, which could transform mobility and generate new revenue streams.

- Full Self-Driving (FSD): Regulatory milestones and adoption rates for Tesla’s FSD system remain critical areas of interest. Updates are anticipated regarding regulatory progress and broader market acceptance.

- Optimus Robot Development: Progress on the Optimus humanoid robot project is being scrutinized for its potential to contribute to Tesla’s long-term technology portfolio.

These advancements represent high-margin, long-term growth opportunities that could offset some near-term margin pressures from the automotive segment.

Market Sentiment and Leadership Outlook

Tesla's stock has rebounded by approximately 85% over the past six months, reflecting improved market sentiment and renewed investor confidence in CEO Elon Musk’s leadership direction. The upcoming shareholder meeting is expected to address concerns surrounding product demand sustainability, margin outlook, and the company’s roadmap in the face of a challenging economic environment.

Conclusion

Tesla’s Q3 2025 earnings report is projected to showcase record vehicle deliveries and steady energy storage deployment growth. However, profitability is expected to face downward pressure due to aggressive price cuts and intensified competition, which erode gross margins. Investors will be closely watching Tesla’s strategic focus on AI, robotics, and autonomous driving technologies as potential catalysts for future sustained growth. The forthcoming earnings call and shareholder meeting will provide critical insights into how Tesla plans to navigate margin challenges while advancing its ambitious innovation agenda under Elon Musk’s renewed leadership.

Frequently Asked Questions

Q: Tesla Q3 2025 earnings preview

A: Tesla's Q3 2025 earnings report is anticipated to highlight its continued growth in electric vehicle production and deliveries, with the potential introduction of updated models or advancements in battery technology. Investors will be watching for revenue growth, gross margin stability, and profitability given ongoing supply chain challenges and increased competition in the EV market. Additionally, updates on Tesla's energy storage and solar businesses, as well as progress on autonomous driving technology, could influence the company's overall financial performance and future outlook.

Q: Tesla vehicle delivery numbers Q3 2025

A: Tesla's vehicle delivery numbers for the third quarter of 2025 have not been publicly disclosed as of now. Typically, Tesla announces its quarterly delivery figures shortly after the quarter ends. For the most accurate and up-to-date information, it's best to check Tesla's official investor relations page or recent press releases once the data is available.

Q: Tesla energy storage deployment Q3 2025

A: In Q3 2025, Tesla is expected to continue expanding its energy storage deployments globally, focusing on its Megapack and Powerwall products. These systems support grid stability, renewable energy integration, and residential energy management. While specific deployment figures for Q3 2025 are not publicly available yet, Tesla's ongoing investments and partnerships suggest a steady increase in installations as demand for clean energy solutions grows.

Q: Tesla Robotaxi update and FSD timeline

A: Tesla's Robotaxi project aims to deploy a fully autonomous taxi service using its electric vehicles paired with Full Self-Driving (FSD) software. As of mid-2024, Tesla continues to improve its FSD Beta with incremental software updates, expanding the number of participants in the public beta testing program. The company has announced plans to launch Robotaxis once FSD achieves a high level of reliability and regulatory approval, though a definitive timeline remains uncertain and widely anticipated to be within the next few years. Tesla frequently emphasizes that real-world data collection and software refinement are critical steps before commercial Robotaxi operations can begin.

Q: Tesla shareholder meeting and management commentary

A: Tesla's shareholder meetings typically include an overview of the company's performance, strategy, and future plans, often presented by CEO Elon Musk and other senior executives. Management commentary during these meetings usually covers topics such as production milestones, product development updates, financial results, and strategic initiatives like energy solutions and autonomous driving technology. Shareholders have the opportunity to ask questions, vote on key proposals, and engage directly with the company's leadership. These meetings provide valuable insights into Tesla's direction and address investor concerns.

Key Entities

Tesla: Tesla, Inc. is an American electric vehicle and clean energy company known for producing electric cars, battery energy storage, and solar products. The article likely discusses Tesla’s market performance or technological advancements in the automotive sector.

Elon Musk: Elon Musk is the CEO of Tesla and a prominent entrepreneur involved in multiple ventures including SpaceX and Neuralink. His leadership and vision influence Tesla’s strategic direction and public perception.

Electrek: Electrek is a news website focused on electric transportation and sustainable energy topics, providing updates on companies like Tesla. It serves as a specialized source for industry developments and technology reviews.

Wall Street: Wall Street refers to the financial district in New York City, home to major stock exchanges and investment firms that influence market dynamics. It plays a crucial role in Tesla’s stock performance through investor behavior and market analysis.

Estimize: Estimize is a financial estimates platform that crowdsources earnings forecasts from a broad community of analysts and investors. It provides alternative predictions that can impact market expectations for companies like Tesla.

External articles

- Tesla (TSLA) Q3 earnings preview: what to expect from its ...

- Tesla Q3 Earnings Preview: What To Expect From ...

- Tesla Q3 Earnings Preview: Record Deliveries “Burn Out,” ...

Articles in same category

- Tesla's Advertising Shift: Promoting Corporate Governance and Musk's Compensation

- Kia Boosts EV Production in Europe with New EV2 and EV4 Models

- Residential Clean Energy Credit Expiration 2025: Solar Adoption Impact

YouTube Video

Title: Tesla earnings, what I'm looking for (the notes, not the numbers)

URL: https://www.youtube.com/shorts/oFRc2enpsb4

Energy