Portugal vs Spain: Tax Regimes, Visa Options & Lifestyle for Long-Term Residents

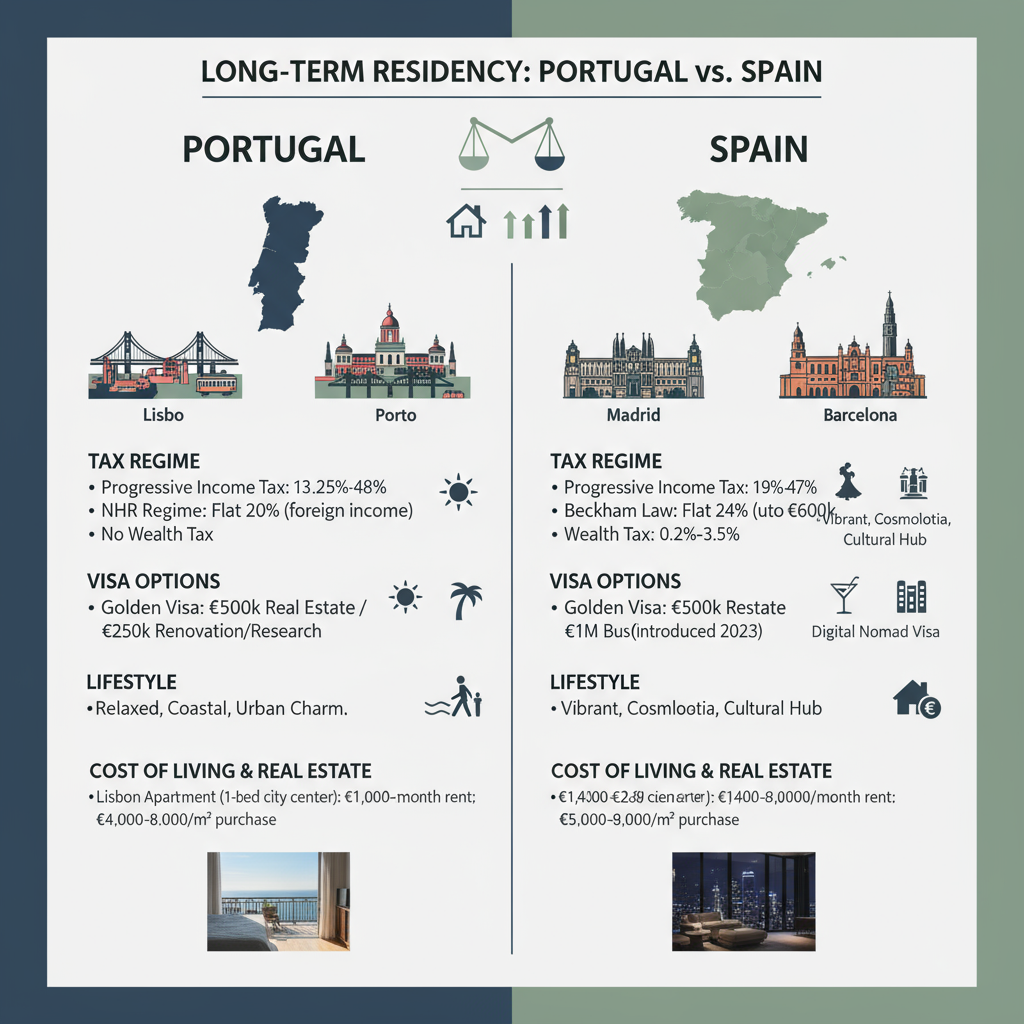

Portugal and Spain, the two main countries on Europe’s Iberian Peninsula, offer attractive options for long-term residents such as business owners, digital nomads, and expatriates. Both countries feature progressive income tax systems but differ notably—Portugal’s tax rates range from about 13.25% to 48%, with a special IFICI regime taxing innovation income at a flat 20% and no wealth tax, while Spain’s rates vary regionally between 19% and 47%, including a wealth tax and the Beckham Law offering a 24% flat rate for certain foreign employees. Visa options differ as well: Spain launched a dedicated Digital Nomad Visa in 2023, while Portugal provides alternatives like the D7 and D8 visas. Portugal also offers faster citizenship after five years compared to Spain’s usual ten. Cost of living and real estate are generally more affordable in Portugal’s cities like Lisbon and Porto than in Madrid and Barcelona. Lifestyle contrasts include Portugal’s relaxed, friendly urban environments with growing tech hubs, versus Spain’s vibrant cosmopolitan cities rich in cultural activities. Both countries have strong healthcare systems, though Spain’s may be more developed in major urban centers. Ultimately, Portugal appeals for tax simplicity, faster citizenship, and affordability, while Spain offers diverse visa pathways and a lively social scene, allowing prospective residents to choose based on their professional goals and lifestyle preferences.

Summary

Comprehensive Comparison of Tax Regimes, Visa Options, and Lifestyle for Long-Term Residents in Portugal and Spain

Europe’s Iberian Peninsula offers attractive opportunities for long-term residents, especially business owners, digital nomads, and expatriates interested in favorable tax regimes, comfortable living, and dynamic social environments. Portugal and Spain, the two prominent countries in this region, distinguish themselves with different tax models, visa programs, residency and citizenship rules, cost of living, and urban experiences. This article provides a detailed comparison of these aspects to help prospective residents make informed decisions.

Taxation Regimes and Legal Certainty

Portugal and Spain both employ progressive income tax rates but with varying structures and special regimes. Portugal’s income tax ranges approximately from 13.25% to 48%, with a forthcoming adjustment to 13% for certain brackets starting in 2025. The country offers a special tax framework known as IFICI, applying a flat 20% rate on qualifying innovation-related income, focusing on research and development activities. This replaces the previous Non-Habitual Resident (NHR) regime for new entrants. Importantly, Portugal does not impose any wealth tax, which simplifies asset management for residents.

In contrast, Spain applies progressive income tax rates from 19% to 47%, varying across regions. The notable Beckham Law allows a flat 24% tax rate on foreign employment income up to €600,000 for up to six years, appealing to high-earning expatriates. However, Spain levies a regional wealth tax ranging from 0.2% to 3.5% on assets exceeding €700,000, along with inheritance taxes that can reach up to 34%, although reduced rates apply for close relatives.

Capital gains taxation also differs. Portugal levies a flat 28% tax with potential reductions for long-term holdings, while Spain charges a progressive rate between 19% and 28% without long-term relief. Regarding cryptocurrency gains, both countries tax such income similarly to capital gains or general income but lack special exemptions or benefits.

Portugal’s tax system is generally perceived as more straightforward and stable with fewer regional variances, enhancing legal certainty. Spain’s regional tax differences, while offering specific incentives, complicate comprehensive tax planning.

Visa Categories, Residency, and Citizenship

Visa programs significantly influence residency options in both countries. Portugal’s Golden Visa requires investments such as €500,000 in real estate, €250,000 in renovation projects, or €250,000 in research funding. Spain’s Golden Visa demands a minimum €500,000 real estate purchase or a €1 million business investment.

For remote workers and digital nomads, Spain introduced a dedicated Digital Nomad Visa in 2023, renewable annually, providing a clear path for remote professionals. Portugal lacks a specific digital nomad visa but offers alternatives through the D7 visa for passive income earners and the D8 visa suitable for remote workers.

Residency timelines are comparable: both countries grant temporary residence after one year and permanent residence after five years. However, Portugal offers a faster citizenship acquisition process, requiring five years of residency and language proficiency, contrasting with Spain’s usual ten-year requirement, with some exceptions for specific nationalities at five years.

Cost of Living, Rent, and Real Estate

The cost of living and property markets also vary between the two countries, particularly in major cities. In Lisbon and Porto, monthly rents for a one-bedroom city-center apartment range from approximately €800 to €1,500, with real estate prices averaging €3,000 to €5,000 per square meter. These costs are generally more affordable compared to Madrid and Barcelona, where rents reach €1,000 to €1,800 per month and real estate prices range from €4,000 to €6,000 per square meter.

Portugal’s lower property prices and living costs make it particularly attractive for long-term residents seeking quality urban living without the premium price tag found in Spain’s top metropolitan areas.

Social Environment and Urban Lifestyle

Social atmosphere and lifestyle play essential roles in choosing a long-term residence. Portugal’s urban centers such as Lisbon and Porto are known for their relaxed and friendly environments, growing expat communities, and emerging tech innovation hubs, making them appealing to digital nomads and entrepreneurs. The cities offer historic, walkable neighborhoods alongside access to natural Atlantic coastlines and scenic mountain regions.

Spain’s major cities, Madrid and Barcelona, provide a more vibrant and cosmopolitan experience with diverse expatriate populations, extensive cultural activities, and dynamic nightlife. The social life tends to be livelier, catering to those valuing urban excitement. Additionally, Spain’s varied Mediterranean coast and the Pyrenees offer diverse natural surroundings.

Healthcare systems in both countries are highly developed. Portugal boasts robust public healthcare complemented by affordable private care options. Spain’s healthcare infrastructure is regarded as superior particularly in its major cities, enhancing access and quality for residents.

Conclusion

For business owners and crypto holders, Portugal’s absence of wealth tax, innovative IFICI regime, and straightforward tax framework may be advantageous. Spain’s Beckham Law remains highly beneficial for foreign employees with substantial salaries seeking flat tax applications. Visa options in Spain cater directly to digital nomads with the new visa scheme, whereas Portugal provides flexible alternatives for passive income earners and remote workers.

Portugal’s expedited citizenship timeline and lower cost of living, including more affordable real estate, can offer decisive benefits. Conversely, Spain delivers a richer urban lifestyle for those prioritizing cultural vibrancy and established expatriate networks.

Prospective residents should engage expert cross-border tax and legal advisors to customize their plans based on individual income profiles, asset portfolios, and lifestyle priorities while taking into consideration the progressive tax rates, property tax implications, inheritance tax, and social security contributions inherent in both countries.

This detailed comparison underscores how Portugal and Spain present distinct yet compelling options for long-term residency, each aligning with different professional and personal aspirations.

Frequently Asked Questions

Q: Spain vs Portugal cost of living

A: The cost of living in Spain and Portugal is relatively comparable, though Portugal is generally considered slightly more affordable. Housing, groceries, and dining out tend to be cheaper in Portugal, especially in cities like Lisbon and Porto compared to major Spanish cities such as Madrid and Barcelona. Utilities and transportation costs are fairly similar, but Spain offers more regional variation. Overall, both countries provide a good quality of life at reasonable prices, with Portugal often preferred by those seeking lower expenses.

Q: Tax advantages in Portugal vs Spain

A: Portugal offers attractive tax advantages such as the Non-Habitual Resident (NHR) regime, which provides reduced tax rates and exemptions on foreign income for up to 10 years. It generally has lower personal income tax rates for high earners compared to Spain. Spain, on the other hand, has incentives in certain regions and for specific activities, but its overall tax burden is often higher, including wealth and inheritance taxes. Both countries have double taxation treaties, but Portugal's favorable schemes are often considered more appealing for expatriates and investors.

Q: Best visa options for digital nomads in Spain and Portugal

A: Spain offers the new Digital Nomad Visa that allows remote workers to live and work legally in the country for up to one year, with the possibility to extend. This visa targets professionals working for companies outside Spain or freelancers with steady income. Portugal features the D7 Visa, suitable for remote workers and freelancers who can demonstrate sufficient passive or active income. Additionally, Portugal has a special Digital Nomad Visa in some regions, making it easier for remote workers to settle. Both countries require proof of income, health insurance, and a clean criminal record for visa approval.

Q: Crypto tax laws in Spain and Portugal

A: In Spain, cryptocurrency is treated as property for tax purposes. Gains from crypto trading are subject to capital gains tax, with rates ranging from 19% to 26% depending on the gain amount. Additionally, income from crypto mining or professional trading may be taxed as regular income. In Portugal, crypto is generally exempt from personal income tax for casual transactions and capital gains, making it a crypto-friendly jurisdiction. However, professional or business-related crypto activities may be subject to taxation under specific conditions.

Q: Relocating business to Spain or Portugal

A: Relocating a business to Spain or Portugal involves understanding each country's legal, tax, and regulatory environments. Spain offers a large domestic market and strong infrastructure, making it attractive for various industries, while Portugal is known for its competitive corporate tax rates and ease of doing business. Both countries provide access to the European Union market, skilled labor, and attractive quality of life for employees. It's essential to consider factors such as local business laws, labor regulations, and potential incentives before making a move.

Key Entities

Lisbon: Lisbon is the capital and largest city of Portugal, known for its historic neighborhoods and coastal location along the Atlantic Ocean. It serves as a cultural, economic, and political center, attracting visitors with its architectural heritage and vibrant atmosphere.

Barcelona: Barcelona is a major Spanish city situated on the Mediterranean coast, renowned for its unique blend of Gothic and modernist architecture, including works by Antoni Gaudí. It is an important cultural and economic hub in Catalonia, famous for its arts, sports, and tourism.

Madrid: Madrid is the capital and largest city of Spain, serving as the political, cultural, and financial heart of the country. It hosts major institutions such as the Royal Palace and the Prado Museum, renowned for its rich art collections.

Portugal: Portugal is a southwestern European country on the Iberian Peninsula, known for its long Atlantic coastline and maritime history. It has a rich cultural heritage and is recognized for its contributions to exploration, cuisine, and traditional music like Fado.

Spain: Spain is a diverse country located on the Iberian Peninsula in southwestern Europe, famous for its varied geography, cultural festivals, and historic sites. It plays a significant role in European politics and economy, with a rich legacy in art, cuisine, and architecture.

External articles

- Retiring in Spain vs Portugal: Visas, Taxes, & More

- Portugal vs Spain for Expats: A 2025 Financial Comparison

- Comparative Analysis: How Americans Can Optimize Their ...

Articles in same category

- Naked Mole-Rats: Unraveling the Secrets of Eusociality and Longevity

- AI Hallucinations in Legal Practice: Court Sanctions Highlight Risks

- Controversy Surrounding AI Judging Tool at Canadian Brewing Awards

YouTube Video

Title: Portugal vs Spain for Expats: Where Should You Move in 2025? 🇵🇹🇪🇸

Channel: Lisbob: The expats' assistant

URL: https://www.youtube.com/watch?v=tw1taSC80Ro

Published: 5 months ago

Technology