Palantir and BigBear.ai AI Stocks: Growth, Risks, and Market Outlook

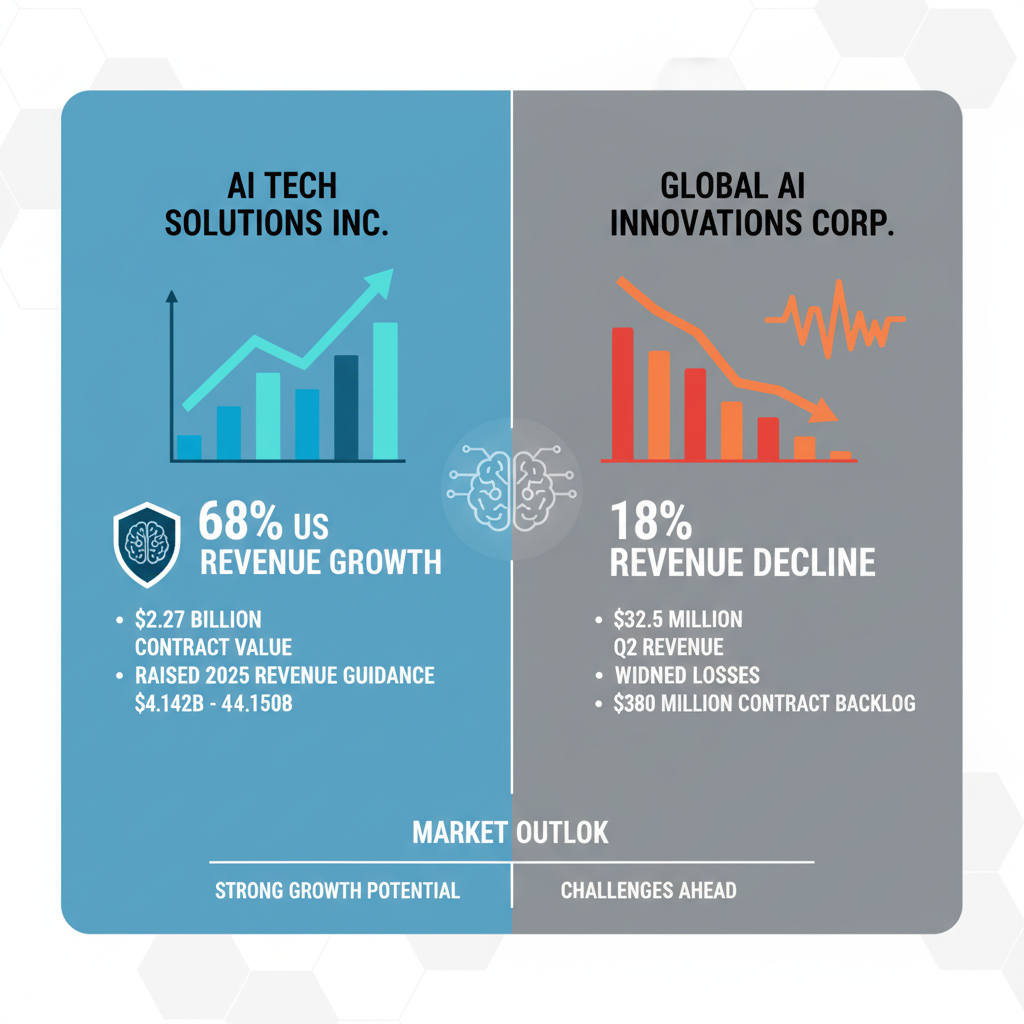

Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI) have both seen their stocks surge over 300% in the past year, driven by growth in the artificial intelligence software market. Palantir posted a strong Q2 2025 with 68% revenue growth in the U.S. and raised its full-year revenue guidance, highlighting robust demand across commercial and government sectors. In contrast, BigBear.ai faced an 18% revenue decline and widened losses despite securing defense contracts and maintaining a strong cash position. BigBear.ai’s stock has been volatile, influenced by heavy short interest and market uncertainty. While Palantir shows solid execution and investor confidence, BigBear.ai’s future hinges on successfully converting defense partnerships into sustainable growth amid execution risks and market volatility. Upcoming quarterly results, especially BigBear.ai’s Q3 report, will be critical for investors assessing these contrasting AI market players.

Summary

Palantir Technologies Inc. PLTR and BigBear.ai Holdings, Inc. BBAI are both capitalizing on the growing artificial intelligence (AI) software solution market, with both stocks gaining more than 300% in the past year.

The expanding market for artificial intelligence (AI) software solutions has been a significant growth driver for both Palantir Technologies Inc. (PLTR) and BigBear.ai Holdings, Inc. (BBAI), with each stock surging over 300% in the last year. Palantir’s strong second-quarter results and raised guidance contrast with BigBear.ai’s recent financial struggles, despite the latter's promising defense-related partnerships and technological advancements. This analysis delves into both companies’ performance, risks, opportunities, and market outlook as investors consider how best to allocate funds between these two AI-focused stocks.

Key Points:

- Palantir reported a robust Q2 with 68% revenue growth in the U.S. and a record $2.27 billion in contract value, raising its full-year 2025 revenue guidance.

- BigBear.ai posted disappointing Q2 results with an 18% revenue decline and widened losses despite defense contract wins and a strong cash position.

- BigBear.ai’s stock has experienced high volatility and is susceptible to short squeezes due to heavy short interest, reflecting substantial market uncertainty.

- Analysts remain split on BigBear.ai: cautious due to financial execution risks and high valuation, but some bullishness driven by government AI demand and a strengthened balance sheet.

- Upcoming quarterly results, especially BigBear.ai’s Q3 report, are critical in determining the company’s ability to convert defense partnerships into sustainable growth.

---

Palantir’s Phenomenal Second Quarter and Raised Guidance

Palantir Technologies showcased stellar financial performance in Q2 2025, under CEO Alex Karp’s leadership. The company reported a 68% year-over-year revenue increase in its U.S. business segment. Commercial revenues grew by 93% and government revenues by 53%, a testament to Palantir’s widespread adoption across sectors.

Palantir secured 157 deals worth at least $1 million each during the quarter, with 66 deals exceeding $5 million in value. This solid sales momentum translated to a record-breaking total contract value (TCV) of $2.27 billion, which is a 140% increase from the prior year. These figures underscore the growing demand for Palantir’s Artificial Intelligence Platform (AIP) in both governmental and commercial markets.

The company also expressed optimism regarding business growth from existing customers and forecasted improved net income for the remainder of the year. Reflecting this confidence, Palantir raised its full-year revenue guidance for 2025 to between $4.142 billion and $4.150 billion. Quarterly revenue estimations for Q3 stand within $1.083 billion to $1.087 billion, signaling continued robust performance.

Palantir’s strong fundamentals and execution effectiveness position it as a dominant player in the AI software landscape, reflecting substantial investor confidence.

---

BigBear.ai’s Financial Setbacks amid Defense Contract Growth

In contrast, BigBear.ai experienced a challenging Q2. Revenues fell by 18% year-over-year to $32.5 million, reflecting disappointments in U.S. government contracts, including the U.S. Army. The company’s previous revenue guidance was lowered from $160–$180 million to $125–$140 million due to delays in contract approvals.

Despite a sizable contract backlog of $380 million, only 4% of this backlog is authorized and secured, highlighting the complex and slow-moving nature of government procurement processes. Moreover, BigBear.ai reported a non-GAAP adjusted EBITDA loss of $8.5 million in Q2, more than double the prior year’s $3.7 million loss. Increased R&D expenses and thin gross margins contributed to these financial pressures.

However, BigBear.ai’s defense-related technological partnerships continue to generate optimism. Notably, a deal with Tsecond to integrate BigBear’s ConductorOS AI platform with rugged hardware aims to bring AI capabilities to tactical edge environments. Additional collaborations with SMX for U.S. Navy exercises and deployment of biometric systems at U.S. airports demonstrate BigBear’s expanding footprint in defense and security arenas.

---

Volatile Stock Performance and Market Sentiment for BigBear.ai

BigBear.ai’s stock has been highly volatile through 2025, fueled partly by heavy short interest currently at 21.5%. This elevated shorting level increases the risk of sharp short squeezes, which have twice propelled the stock price upwards by over 90% this year. Despite this, the stock often experiences substantial pullbacks, reflecting jittery investor sentiment.

Trading around the mid-$7 range by late October 2025, BigBear.ai shares had recently declined from highs near $9 following profit-taking after new defense contracts were announced. The high volatility, with daily moves frequently exceeding 10%, presents both risks and opportunities for investors.

Analysts present a mixed view on BigBear.ai. Most assign a “Hold” rating with average price targets around $6, suggesting a potential 20–25% downside amid execution risks and lofty valuation multiples (approximately 13× projected 2025 sales). Independent valuation models suggest the stock may be overvalued by about 21%.

Conversely, some bullish analysts, such as those from H.C. Wainwright, highlight BigBear’s strengthened balance sheet, a record cash reserve nearing $390 million, and increasing government defense spending as key growth catalysts. These experts encourage accumulation during price dips, projecting BigBear could capitalize on the growing defense AI market.

---

BigBear.ai’s "Mini-Palantir" Profile and Growth Challenges

Nicknamed “mini-Palantir” in defense technology circles, BigBear.ai shares strategic similarities with Palantir but operates on a much smaller scale. BigBear focuses specifically on AI for military and intelligence sectors, already supporting autonomous drone projects and biometric security at multiple U.S. airports.

The company is extending its global reach through partnerships in the UAE and Panama, reflecting ambitions to emulate Palantir’s international defense strategy. However, with roughly $30 million in quarterly sales and dependence on a few government contracts, BigBear faces substantial execution risk.

Market observers warn that inconsistent government contract timing or delays could unsettle growth expectations. The company’s road to profitability remains uncertain, and successful conversion of its multi-year backlog into steady revenue streams will be critical.

---

Future Outlook: High Stakes for BigBear.ai

Looking ahead, the forthcoming Q3 earnings report, scheduled for November 10, 2025, is pivotal for BigBear.ai. Investors and analysts will scrutinize whether recent contract wins begin to translate into revenue stabilization or growth, and if losses can be managed downward.

In a favorable scenario, accelerated backlog monetization and federal AI spending expansion could propel BigBear’s stock beyond current highs, with some models anticipating $20 or more per share. This optimistic view assumes significant revenue increase and eventual profitability.

However, the downside risks are equally pronounced. Government contracts are prone to delays and budget uncertainties, and any continued revenue stagnation or widening losses may erode investor confidence. Volatility is expected to persist, driven by speculation and broader market trends affecting AI stocks.

Long-term investors will watch for sustained revenue growth toward $200 million annually and path to breakeven in 2026. Failure to demonstrate this progress could make BigBear’s premium valuation hard to justify.

---

Conclusion: Contrasting Fortunes in AI Market Leaders

While Palantir Technologies continues to showcase commanding growth and financial strength in the AI software sector, BigBear.ai faces a more precarious path. The smaller company’s promising defense partnerships and solid cash reserves are tempered by disappointing recent financial results and high execution risk.

BigBear.ai’s wild stock performance embodies the dual nature of emerging AI firms: immense opportunity paired with considerable volatility and uncertainty. The coming quarters, especially the November earnings report, will critically influence whether BigBear can fulfill investor expectations or face setbacks.

Investors interested in AI growth stocks should weigh Palantir's proven results against BigBear’s speculative potential, keeping in mind the substantial risks inherent in the small-cap defense AI market.

---

Sources: BigBear.ai press releases and earnings reports; TechStock² news analysis; The Economic Times; Nasdaq/Zacks research; Simply Wall St valuation report; CityBiz defense tech commentary; H.C. Wainwright analyst notes; BigBear.ai investor presentation and SEC filings.

Questions and answers

Q: Palantir Q2 2025 financial results

A: Palantir's Q2 2025 financial results showed continued growth in revenue driven by strong demand for its data analytics platforms across both government and commercial sectors. The company reported increased bookings and a healthy pipeline of new contracts, reflecting confidence in its AI-driven solutions. Profitability metrics improved as Palantir optimized operational efficiency, although investments in research and development remained significant to maintain technology leadership.

Q: BigBear.ai stock volatility reasons

A: BigBear.ai's stock volatility in recent periods can be attributed to fluctuating investor sentiment around its defense contract wins and competitive positioning in AI analytics. Market reactions to quarterly earnings reports and contract announcements often cause sharp price movements. Additionally, broader market trends in technology stocks and concerns about government spending on defense and AI projects contribute to share price variability.

Q: Comparison of Palantir and BigBear.ai AI strategies

A: Palantir focuses on providing scalable, data integration and analytics platforms that support large enterprises and government clients, emphasizing customized AI solutions embedded in its software. BigBear.ai, on the other hand, concentrates on AI-powered analytics with a strong emphasis on defense and intelligence applications, leveraging autonomous intelligence and predictive analytics. While both leverage AI, Palantir has a broader commercial reach, whereas BigBear.ai’s strategy is more specialized towards defense and national security.

Q: Impact of defense contracts on BigBear.ai

A: Defense contracts are critical to BigBear.ai’s business, providing a stable revenue stream and opportunities for growth through advanced AI and data analytics solutions tailored for military and intelligence agencies. These contracts enhance the company’s credibility and technological capabilities, often leading to repeat business and partnerships. As defense budgets prioritize AI innovation, BigBear.ai benefits from increased funding and demand for cutting-edge analytics tools.

Q: Prospects for AI growth stocks 2025

A: AI growth stocks in 2025 are expected to perform well, driven by accelerating adoption of artificial intelligence across industries such as healthcare, finance, and defense. Continued innovation and expansion in AI technologies, including machine learning and autonomous systems, support positive outlooks for companies focused on AI. However, investors should consider regulatory developments and market competition as factors influencing the growth trajectories of these stocks.

Key Entities

Palantir Technologies Inc.: Palantir Technologies Inc. is a public American software company specializing in big data analytics and artificial intelligence for government and commercial clients. The company is known for its platforms Gotham and Foundry, which integrate, manage, and analyze complex data sets.

BigBear.ai Holdings, Inc.: BigBear.ai Holdings, Inc. is an AI-driven analytics company that provides predictive analytics and decision support solutions to defense and intelligence sectors. It focuses on delivering actionable insights through machine learning and data science technologies.

Alex Karp: Alex Karp is the co-founder and CEO of Palantir Technologies Inc., leading the company since its inception in 2003. He is known for his strategic vision in leveraging data analytics for security and intelligence applications.

Tsecond: Tsecond appears to be a term rather than a recognized entity; if referring to a specific product or concept, more context is needed to provide an accurate summary. Without additional information, no concise description can be offered.

SMX: SMX commonly refers to Search Marketing Expo, a conference focused on search engine marketing and optimization. In other contexts, it could denote different entities; clarification is necessary to give a precise summary.

External articles

- Palantir Technologies: Stretched Or Not, This AI Rally Isn't ...

- Prediction: 1 Artificial Intelligence (AI) Stock Will Be Worth ...

- 1 AI Stock Could Be Worth More Than Nvidia and Palantir ...

Articles in same category

- Old National Bancorp Q3 2025 Earnings Beat with 46.8% Revenue Surge

- Trump Administration Expands Student Loan Forgiveness Under Income-Driven Plans

- Crumbl Cookies and 7 Brew Drive-Thru Coffee Expand to Salisbury Amid BYU Field Storming Controversy

YouTube Video

Title: Can Big Bear AI Become The Next Palantir?! 🤔

Channel: Prospero_ai

URL: https://www.youtube.com/watch?v=Awgp1l1R_Rc

Published: 8 months ago

Money