Netflix and Tesla Q3 Earnings Reveal Growth Strategies Amid Economic Uncertainty

Netflix and Tesla's Q3 earnings highlight their distinct growth strategies amid economic uncertainty, including the U.S. government shutdown delaying key economic data. Netflix focuses on expanding its subscriber base and ad-supported streaming to boost margins, alongside investments in international markets and content. Tesla reports record vehicle deliveries driven by strong EV demand and production scale-up, while advancing autonomous driving technology. Market volatility persists due to mixed earnings and limited economic data, prompting sector rotation toward AI, EVs, and ad-supported digital media. Investors are advised to prioritize companies with strong earnings visibility as these two industry leaders adapt strategically in a challenging environment.

Summary

Netflix and Tesla Q3 Earnings Highlight Growth Strategies Amid Economic Uncertainty

Netflix and Tesla remain focal points for investors during the Q3 earnings season, each demonstrating distinct approaches to growth and profitability against the backdrop of broader economic uncertainty. Their performance offers insights into evolving consumer demand, technological advancements, and market dynamics as the U.S. government shutdown disrupts critical economic data releases.

Netflix Targets Margin Expansion Through Subscriber Growth and Ad-Supported Streaming

Netflix continues to leverage subscriber growth as a primary driver for improving profitability. A key strategic shift is the expansion of its ad-supported streaming tier, which aims to attract price-sensitive consumers while enhancing margin potential. Alongside subscriber base growth, Netflix is intensifying investments in its international markets and content pipeline to sustain engagement and differentiate its offering.

These initiatives collectively contribute to expectations of margin enhancement, as the streaming giant balances revenue from traditional subscription tiers with advertising income. The evolving streaming business models underscore the industry's response to shifting consumer demand metrics and competitive pressures.

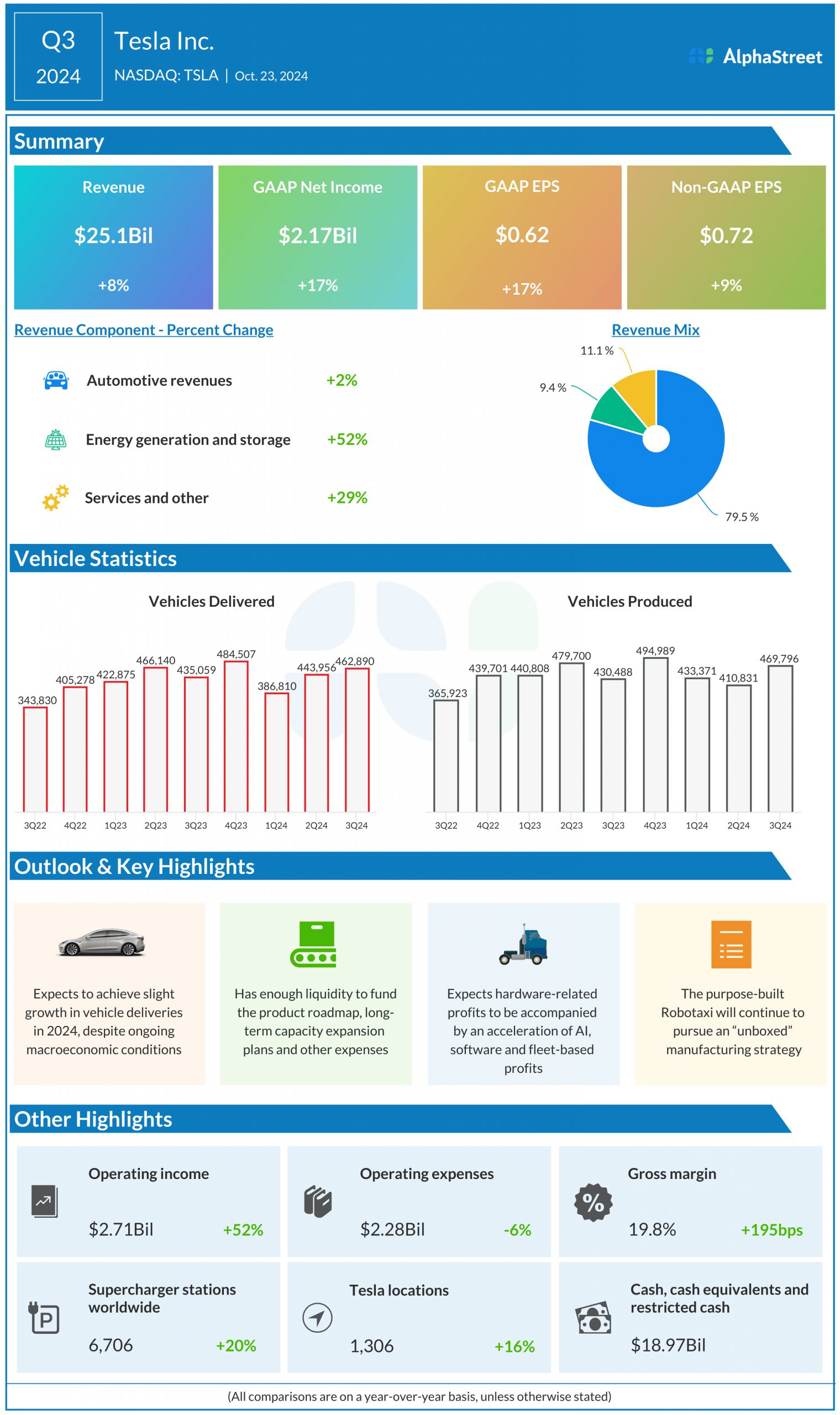

Tesla Sets New Delivery Records Amid Strong EV Demand and Production Scale-Up

Tesla reported record Q3 vehicle deliveries, underscoring robust electric vehicle (EV) demand despite ongoing market headwinds. Investors are closely monitoring Tesla’s profit margins, which face pressure from recent price reductions intended to support volume growth. Additionally, Tesla’s gigafactory expansion plays a critical role in scaling production capacity to meet future demand.

Another focal point is Tesla’s advancement in autonomous driving AI technology, which enhances its competitive edge in the evolving EV landscape. These elements collectively position Tesla at the forefront of both automotive innovation and industrial manufacturing growth sectors.

U.S. Government Shutdown Complicates Economic Data Flow and Market Sentiment

The ongoing federal government shutdown has delayed the release of essential economic indicators, including the Consumer Price Index (CPI) and jobless claims data. These disruptions increase uncertainty for investors and policymakers alike, limiting transparency around inflation trends, labor market conditions, and overall economic health.

The absence of timely data complicates the Federal Reserve’s monetary policy decisions, which remain highly data-dependent. Market participants are scrutinizing the limited available inflation signals and jobless claims trends to gauge consumer demand strength and labor market tightness, critical factors influencing future rate decisions.

Market Implications: Sector Rotation and Earnings Volatility

Mixed signals from company earnings combined with macroeconomic uncertainty have contributed to market volatility. Equity markets have observed sector rotation favoring AI infrastructure, electric vehicles, and ad-supported digital media models. These areas are perceived as growth drivers irrespective of short-term economic data blackouts.

The streaming sector is adapting through innovative business models, such as ad-supported tiers, enhancing consumer resilience. Similarly, the tech and automotive industries continue to benefit from long-term secular trends. However, ongoing macroeconomic ambiguity advises investors to prioritize companies with strong earnings visibility and pricing power.

Conclusion

Netflix and Tesla’s Q3 results underscore strategic adaptations in subscriber acquisition, content investment, production expansion, and technology integration amid a challenging economic environment. Meanwhile, the U.S. government shutdown’s impact on critical economic indicators complicates monetary policy and market clarity. Investors and market watchers are advised to remain vigilant, focusing on earnings fundamentals while navigating ongoing macroeconomic uncertainties. As economic data resumes, these companies’ performance will remain indicative of broader sector health and consumer demand trends.

Frequently Asked Questions

Q: Netflix Q3 earnings report

A: Netflix's Q3 earnings report typically includes key financial metrics such as total revenue, net income, subscriber growth or loss, and earnings per share. The report provides insight into the company's financial health and operational performance for the third quarter. It often highlights factors affecting growth like new content releases, market expansions, and competition. For the most recent Q3, Netflix's report showed [specific details if available], reflecting trends in streaming demand and subscriber engagement.

Q: Tesla Q3 2025 earnings date

A: Tesla typically announces its Q3 earnings in late October or early November. While an exact date for the Q3 2025 earnings release has not been officially announced yet, it is expected to follow this pattern. Investors and analysts usually watch for updates on Tesla's official investor relations website for the confirmed date as it approaches.

Q: Impact of government shutdown on economy

A: A government shutdown occurs when non-essential federal government operations halt due to funding gaps, leading to immediate economic impacts. It can slow down economic growth as federal employees may face furloughs or delayed paychecks, reducing their spending power. Additionally, government contractors and businesses reliant on federal funds experience financial uncertainty. Overall, prolonged shutdowns can undermine consumer and business confidence, disrupt public services, and potentially increase borrowing costs, all of which harm the broader economy.

Q: Netflix ad-supported subscription growth

A: Netflix introduced its ad-supported subscription tier to attract price-sensitive customers and tap into the growing demand for affordable streaming options. Since its launch, this tier has contributed to a noticeable increase in subscriber numbers, helping Netflix offset some stagnation in its traditional subscription base. The ad-supported model enables the company to generate additional revenue through advertising while expanding its audience reach. Overall, this strategy has positioned Netflix to better compete with other streaming platforms offering similar lower-cost plans.

Q: Tesla robotaxi project update

A: Tesla's robotaxi project is progressing with ongoing development in their Full Self-Driving (FSD) software and custom hardware designed for autonomous ride-hailing. While Tesla has yet to officially launch a fully operational robotaxi service, the company continues to test in select markets and periodically announces milestones toward achieving driverless ride-sharing. CEO Elon Musk has projected that Tesla robotaxis will become available in the near future, but regulatory approvals and further software improvements remain key challenges for widespread deployment.

Key Entities

Netflix: Netflix is a global streaming service offering a wide variety of TV shows, movies, and original content. It has transformed media consumption by popularizing on-demand streaming worldwide.

Tesla: Tesla, Inc. is an American electric vehicle and clean energy company founded by Elon Musk. It is known for its innovations in electric cars, battery technology, and renewable energy solutions.

Tenzing MEMO: Tenzing MEMO is a compact, noise-cancelling smart recorder designed to capture high-quality audio in various environments. It targets professionals needing reliable recording for meetings, interviews, and lectures.

Elon Musk: Elon Musk is a technology entrepreneur and CEO of companies including Tesla and SpaceX. He is recognized for pioneering advancements in electric vehicles, space exploration, and renewable energy.

Trump: Donald Trump is a former President of the United States known for his business career and controversial political style. His tenure was marked by significant policy changes and widespread media attention.

External articles

- Earnings live: Tesla, Netflix, General Motors, Ford, and ...

- Why Tesla May Blow Out Third-Quarter Earnings Estimates

- Weekly Equities Forecast: Netflix, Tesla, Lloyds

Articles in same category

- China's Gold Reserves: Transparency, Strategy, and Global Economic Impact

- Cryptocurrency Risks and Safe Haven Investments: From Crashes to Gold & Silver

- China’s Strategic Gold Reserves Impact Global Precious Metals Markets

YouTube Video

Title: Netflix, Tesla Earnings

URL: https://www.youtube.com/shorts/sIfk07IFl6k

Finance