China’s Strategic Gold Reserves Impact Global Precious Metals Markets

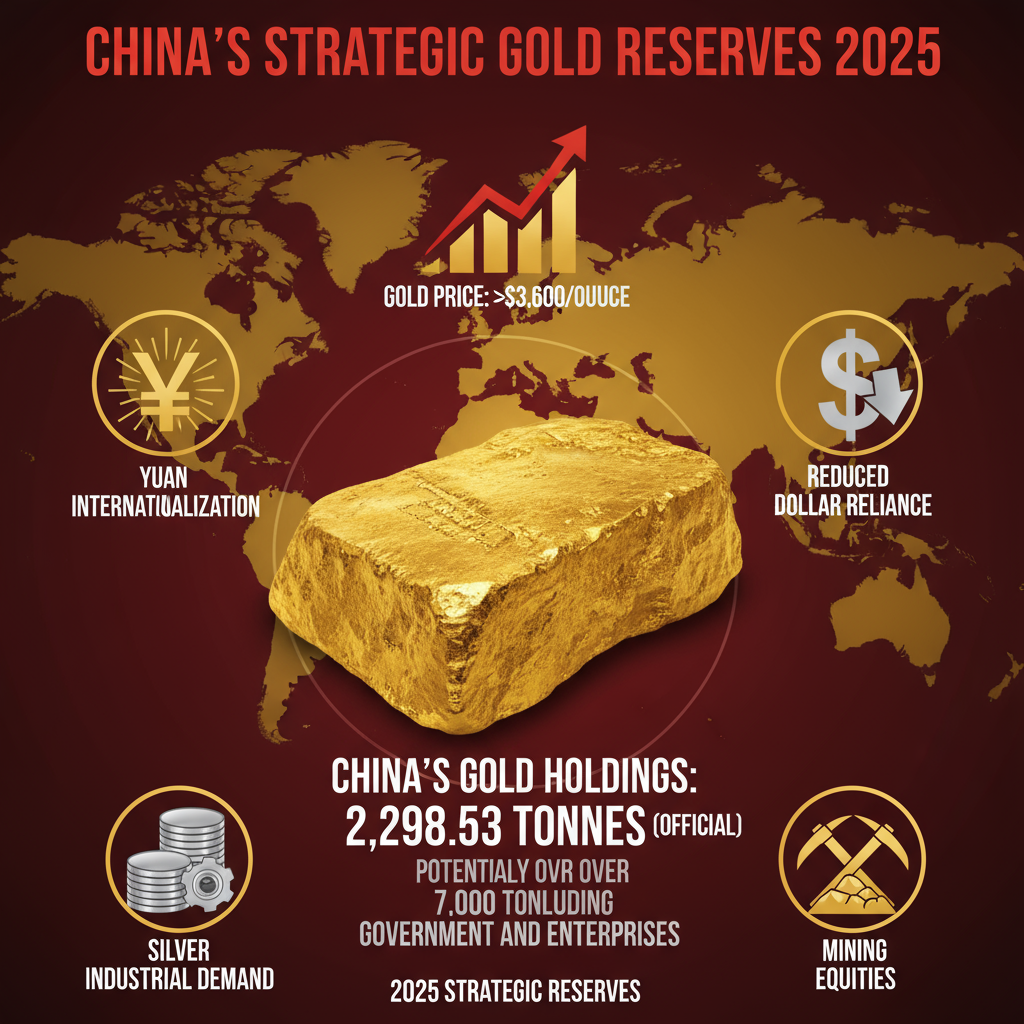

As of mid-2025, China continues to amass gold reserves as part of a strategic effort to diversify reserves, reduce reliance on the US dollar, and boost the yuan's global standing. While official holdings stand at around 2,298.53 tonnes, actual reserves may exceed 7,000 tonnes when including state-owned entities. This accumulation supports China's geopolitical goals of de-dollarization and challenges Western financial dominance, with the Shanghai Gold Exchange playing a key role in facilitating gold trade to promote yuan internationalization. Central bank gold buying, led by China and other non-Western nations, has pushed gold futures past $3,600 per ounce, with forecasts suggesting potential rises above $5,000 as diversification efforts continue. Silver prices remain more volatile due to industrial demand. For investors, the sustained demand for precious metals amid geopolitical uncertainty offers opportunities in mining equities, though risks from commodity cycles and rising bond yields persist. Overall, China’s gold strategy represents a major shift in global financial dynamics, emphasizing precious metals as essential tools for geopolitical risk management and monetary diversification.

Summary

China’s Strategic Gold Reserves and Their Impact on Global Precious Metals Markets

As of the second quarter of 2025, China continues its extensive accumulation of gold reserves, reflecting a broader strategy of reserve diversification and geopolitical risk hedging. Official data reports Chinese gold holdings at approximately 2,298.53 tonnes, supported by an 11-month consecutive streak of central bank gold buying. However, analysts widely suggest this official figure underestimates actual holdings, which may surpass 7,000 tonnes when including reserves held by government bodies and state-owned enterprises. This sustained accumulation plays a critical role in China’s efforts to reduce reliance on the US dollar, promote yuan internationalization, and challenge Western financial dominance.

China’s Gold Accumulation and Geopolitical Strategy

China’s ongoing gold accumulation is a deliberate component of its geopolitical and macroeconomic strategy. By increasing its gold reserves, China aims to:

- Diversify its official reserves away from the dollar.

- Enhance the international stature of the yuan as a global currency.

- Establish itself as a significant custodian of bullion, potentially reshaping global monetary frameworks.

This multi-layered buildup underscores China’s intent to address dollar de-dollarization and diminish the influence of Western financial systems, utilizing gold as a strategic geopolitical tool. The Shanghai Gold Exchange plays an instrumental role in these efforts, facilitating domestic and international gold trading that supports yuan internationalization objectives.

Central Bank Gold Buying and Global Price Dynamics

The trend of central bank gold buying, led by China and other non-Western institutions, has exerted upward pressure on gold futures prices. Comex gold futures have recently surged past $3,600 per ounce amid this growing demand. Market analysts project further significant gains, potentially surpassing $5,000 per ounce if central banks accelerate their diversification from dollar assets.

Silver, while linked to gold, exhibits greater price volatility caused by its stronger industrial demand component. Industrial silver demand, especially from manufacturing and technology sectors, contributes to this variability, complicating market outlooks. Despite price fluctuations, recent buying activity should be interpreted as part of strategic positioning rather than an imminent market peak.

Investment Implications for Precious Metals and Mining Equities

The persistent demand for precious metals supported by geopolitical uncertainties and central bank reserve policies presents notable opportunities for investors in mining equities. Gold and silver mining companies stand to benefit from elevated prices and sustained demand. However, investors should remain mindful of commodity cycle risks and the influence of external factors such as rising government bond yields, which affect the opportunity cost of holding non-yielding assets like gold and silver.

Speculative positioning remains moderated by ongoing geopolitical tensions and a structural shift toward de-dollarization, reinforcing the role of precious metals as global safe-haven assets. Consequently, the market dynamics reflect fundamental reserve accumulation patterns and risk management strategies rather than purely speculative momentum.

Conclusion

China’s large-scale gold accumulation, both official and concealed, signifies a fundamental shift in global financial dynamics, reinforcing precious metals’ central role in geopolitical risk hedging and monetary diversification. The ongoing central bank gold buying trend supports a bullish outlook for gold prices, while silver’s industrial demand adds complexity to its price trajectory. For investors, understanding these drivers and the interplay between geopolitical shifts and precious metals markets will remain essential in navigating mining equities and futures prices in the evolving global economy.

Frequently Asked Questions

Q: Did Friday mark the top of the gold market?

A: Determining whether Friday marked the top of the gold market depends on various factors like price trends, market sentiment, and economic indicators. Gold prices fluctuate due to supply and demand, geopolitical events, and currency movements. Without specific data from that Friday and subsequent days, it's difficult to conclusively say if it was the market's peak. Typically, analysts look for confirming patterns or significant declines after a high to confirm a top in the gold market.

Q: Impact of China's gold holdings on global finance

A: China's growing gold reserves have significant implications for global finance, as increased holdings can influence gold prices and investor confidence in gold as a safe asset. By diversifying its reserves with gold, China reduces reliance on the US dollar, potentially affecting foreign exchange markets and international trade dynamics. Additionally, China's gold accumulation signals its intent to strengthen its financial sovereignty and promote the yuan's role in global markets, which may gradually alter global monetary policies and reserve compositions.

Q: Current trends in gold and silver markets

A: Gold and silver markets have recently experienced increased volatility due to geopolitical tensions and fluctuating economic data. Investors often turn to these precious metals as safe-haven assets during times of uncertainty, driving demand and prices upward. However, rising interest rates and a stronger US dollar can exert downward pressure on prices. Additionally, industrial demand, particularly for silver, remains an important factor influencing market trends. Overall, the metals' prices are influenced by a complex mix of economic, political, and market conditions.

Q: Investment opportunities in Sierra Madre Gold and Silver

A: Sierra Madre Gold and Silver is a Canadian junior mining company focused on exploration and development of precious metals projects in Mexico. Investment opportunities typically involve buying shares in the company, which can offer exposure to gold and silver markets through potential discoveries and project advancements. As with most junior miners, investments carry risks related to exploration results, regulatory approvals, and commodity price fluctuations, but also the potential for high returns if projects succeed. Investors should conduct thorough due diligence, considering current project status and market conditions.

Q: Analysis of gold and silver market queues worldwide

A: Gold and silver markets globally are influenced by factors such as economic data, geopolitical tensions, inflation expectations, and currency fluctuations. Currently, investor demand remains robust due to concerns over economic uncertainty and inflation, which typically boost precious metal prices. Supply chain issues and production costs also affect market dynamics. Monitoring futures contracts, trading volumes, and price trends across major markets like London, New York, and Shanghai offers insight into market sentiment and potential price movements.

Key Entities

Dominic Frisby: Dominic Frisby is a British author and financial commentator known for his work on economics and investing. He has written books on topics such as cryptocurrency and economic theory, contributing to public understanding of financial markets.

China: China is the world's most populous country and a major global economic power located in East Asia. Its economy and industrial policies significantly influence global markets and international trade dynamics.

Singapore: Singapore is a sovereign city-state in Southeast Asia known for its strategic port and status as a global financial hub. It plays a key role in international commerce and regional economic integration.

Sydney: Sydney is the largest city in Australia and a major financial and cultural center. Known for its iconic landmarks like the Sydney Opera House, it serves as a pivotal hub for business and tourism in the Asia-Pacific region.

Sierra Madre Gold and Silver: Sierra Madre Gold and Silver is a Canadian mining company focused on the exploration and development of precious metal resources, primarily in Mexico. The company aims to advance its projects to production and contribute to the mining industry.

External articles

- A warning to the public as gold and silver prices skyrocket

- Silver Squeeze 2025: The 45-Year Chart Pointing to Triple- ...

- Did Friday mark the interim top in gold and silver we have ...

Articles in same category

- China's Gold Reserves: Transparency, Strategy, and Global Economic Impact

- Cryptocurrency Risks and Safe Haven Investments: From Crashes to Gold & Silver

- Silver Price Surge and Investment Opportunities with Sierra Madre Gold and Silver

YouTube Video

Title: The 5% Rule That Builds Quiet Wealth | Silver Stacking

URL: https://www.youtube.com/shorts/SInmSnpFTDg

Finance