Impact of Norwegian Krone Depreciation on Foreign Workers and Economy

Over the past 15 years, the Norwegian krone (NOK) has depreciated significantly against major currencies like the US dollar, primarily due to declining oil prices and low interest rates set by Norges Bank. This depreciation has affected foreign workers in Norway by reducing their purchasing power amid rising living costs and inflation, leading to real income erosion and challenges in housing affordability. While some groups such as exporters and foreign-currency earners benefit from a weaker krone, many expatriates face financial strains that influence their residency decisions. This dynamic underscores the complex interplay between currency fluctuations, monetary policy, and economic conditions impacting both the Norwegian economy and its diverse workforce.

Summary

The Impact of Norwegian Krone Depreciation on Foreign Workers and the Economy

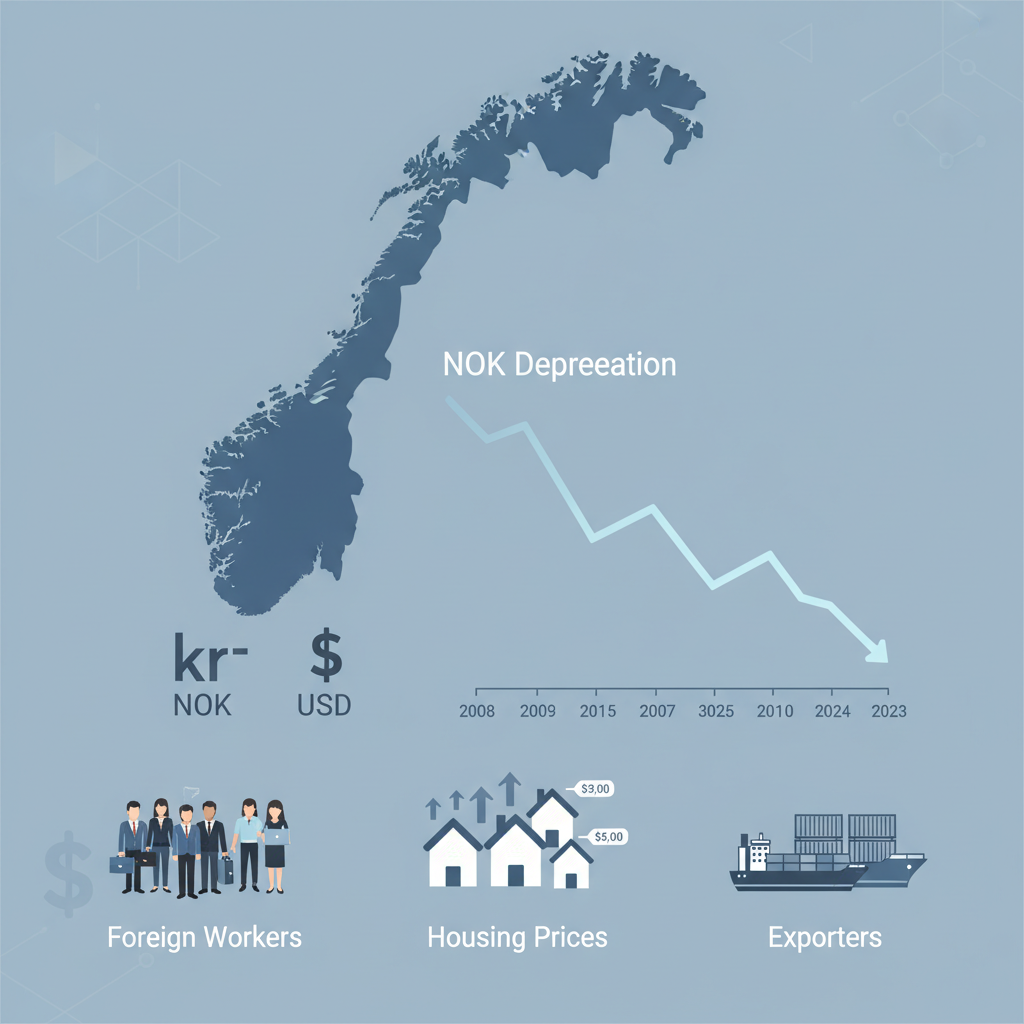

Over the past 15 years, the Norwegian krone (NOK) has experienced significant depreciation, particularly against major currencies such as the US dollar. By 2025, the NOK/USD exchange rate hovers around 10 to 11 kroner per dollar, marking a notable weakening compared to historical levels. This trend is rooted in structural economic changes and monetary policy decisions that have broad implications for foreign labor, expatriates, and the wider Norwegian economy.

Causes of the NOK Depreciation

The primary driver behind the currency depreciation is the sustained decline in oil prices since 2014, which has directly impacted Norway’s oil-export dependent economy. As oil revenues contracted, so too did investor confidence in NOK-denominated assets. Concurrently, Norges Bank’s monetary policy has maintained relatively low interest rates compared to other countries. This approach, intended to support domestic economic objectives, has inadvertently reduced the attractiveness of the krone to foreign investors, further pressuring its value.

Consequences for Foreign Workers in Norway

Foreign labor markets in Norway are particularly sensitive to fluctuations in the krone’s value. Many expatriates and foreign workers receive salaries denominated in NOK, making them vulnerable to currency depreciation when measuring their income against international standards. The reduced purchasing power resulting from the weaker krone is compounded by inflationary pressures within Norway, which have driven up living costs including housing prices.

As a result, real income erosion is a common experience for expatriates. Despite nominal salary stagnation or slow growth, inflation and rising import costs increase the cost of essentials, making saving difficult and housing affordability a critical challenge. While Norway offers non-monetary benefits such as excellent public services and high quality of life, these financial strains have led some foreign workers to reconsider their residency, influencing migration decisions away from Norway.

Beneficiaries of the Weak Krone

Conversely, certain groups benefit from the NOK depreciation. Norwegian exporters see improved competitiveness abroad as their goods become relatively cheaper for foreign buyers. Similarly, individuals earning income in foreign currencies benefit from favorable exchange rates when converting earnings into NOK. These gains underscore the asymmetrical effects of currency movements across different economic sectors and populations.

Broader Economic Implications

The interaction between currency depreciation, inflationary pressures, salary stagnation, and housing market dynamics presents a complex economic environment. The Norwegian krone’s weakness reflects broader challenges including Norges Bank’s monetary policy balancing act and global oil market volatility. For many expatriates, the combined effects manifest as financial challenges that diminish their standard of living and complicate long-term financial planning.

Conclusion

The depreciation of the Norwegian krone against the US dollar and other major currencies over the last decade and a half has created distinct winners and losers within Norway’s economy. While exporters and foreign-currency earners capitalize on the weak krone, foreign workers face real income stagnation and increased living costs, affecting their financial well-being and migration choices. This situation highlights the intricate relationship between currency fluctuations, monetary policy, and the economic realities experienced by a diverse population living and working in Norway.

Frequently Asked Questions

Q: Impact of weak Norwegian krone on foreigners

A: A weak Norwegian krone (NOK) means that foreigners get more NOK for their home currency, making travel and purchases in Norway cheaper for them. This can encourage more tourism and spending by foreigners in Norway. However, for foreign investors, a weak krone might reduce the value of their Norwegian assets when converting back to their own currency, potentially affecting investment returns.

Q: Cost of living in Norway for expats

A: The cost of living in Norway for expats is generally high compared to many other countries, with expenses like housing, food, transportation, and healthcare reflecting the country's strong economy and high standard of living. Major cities such as Oslo and Bergen tend to be more expensive, especially for rent and dining out. However, expats benefit from excellent public services, safety, and quality of life. Budgeting carefully and understanding local costs can help expats manage living comfortably in Norway.

Q: Salary trends in Norway

A: Salary trends in Norway have shown steady growth over recent years, driven by strong economic performance and low unemployment rates. Key sectors such as oil and gas, technology, and healthcare tend to offer higher-than-average wages. Additionally, Norway's strong labor unions and collective bargaining agreements contribute to relatively equitable salary increases across various industries. Factors like inflation and cost of living also influence annual wage adjustments.

Q: Why do people leave Norway

A: People leave Norway for various reasons including employment opportunities, education, family reunification, or a desire for new experiences. Some may move to countries with warmer climates or to be closer to relatives. Additionally, the high cost of living in Norway can be a factor prompting individuals to relocate to more affordable places.

Q: How currency affects salaries in Norway

A: Currency fluctuations can impact salaries in Norway, especially for expatriates and businesses engaged in international trade. The Norwegian krone (NOK) strength influences purchasing power and salary competitiveness compared to other countries. When the krone is strong, salaries in NOK have higher value abroad, benefiting those earning in NOK and spending in foreign currencies. Conversely, a weaker krone can reduce income value internationally but might boost export-driven sectors, potentially affecting wage growth.

Key Entities

Norwegian krone: The Norwegian krone is the official currency of Norway, abbreviated as NOK. It is a stable currency used for both domestic transactions and international trade, influenced by Norway’s oil-driven economy.

Norway: Norway is a Nordic country known for its rich natural resources and high standard of living. It maintains a strong economy supported by industries such as oil and gas, fisheries, and maritime sectors.

The Economist: The Economist is an international weekly publication that provides analysis on global economic and political developments. It is recognized for its data-driven insights and coverage of financial markets.

Oslomet: Oslomet is a university located in Oslo, Norway, specializing in applied sciences and professional education. It engages in research and projects related to social sciences, technology, and health.

EXITNORWAY research project: The EXITNORWAY research project focuses on issues related to organized crime and extremism within Norway. It aims to develop strategies for prevention and disengagement from criminal networks.

External articles

- What Norway's weak currency means for foreigners

- How is weak NOK affecting your life ? : r/Norway

- Is it so strange the NOK is weak?

Articles in same category

- Navigating the Norwegian Job Market: Overcoming Immigrant Hiring Challenges

- Snikskryting: Norway’s Unique Humblebragging Reflecting Social Inequality

- How Norwegians Achieve Unique English Proficiency Through Education and Culture

YouTube Video

Title: Making €100,000+ per year working offshore in Norway #offshore #oilandgas #money #europe

URL: https://www.youtube.com/shorts/pLtD-3FSCh0

Domestic