Gold Investing Strategies in the 2024-2025 Bull Market: Timing and Trends

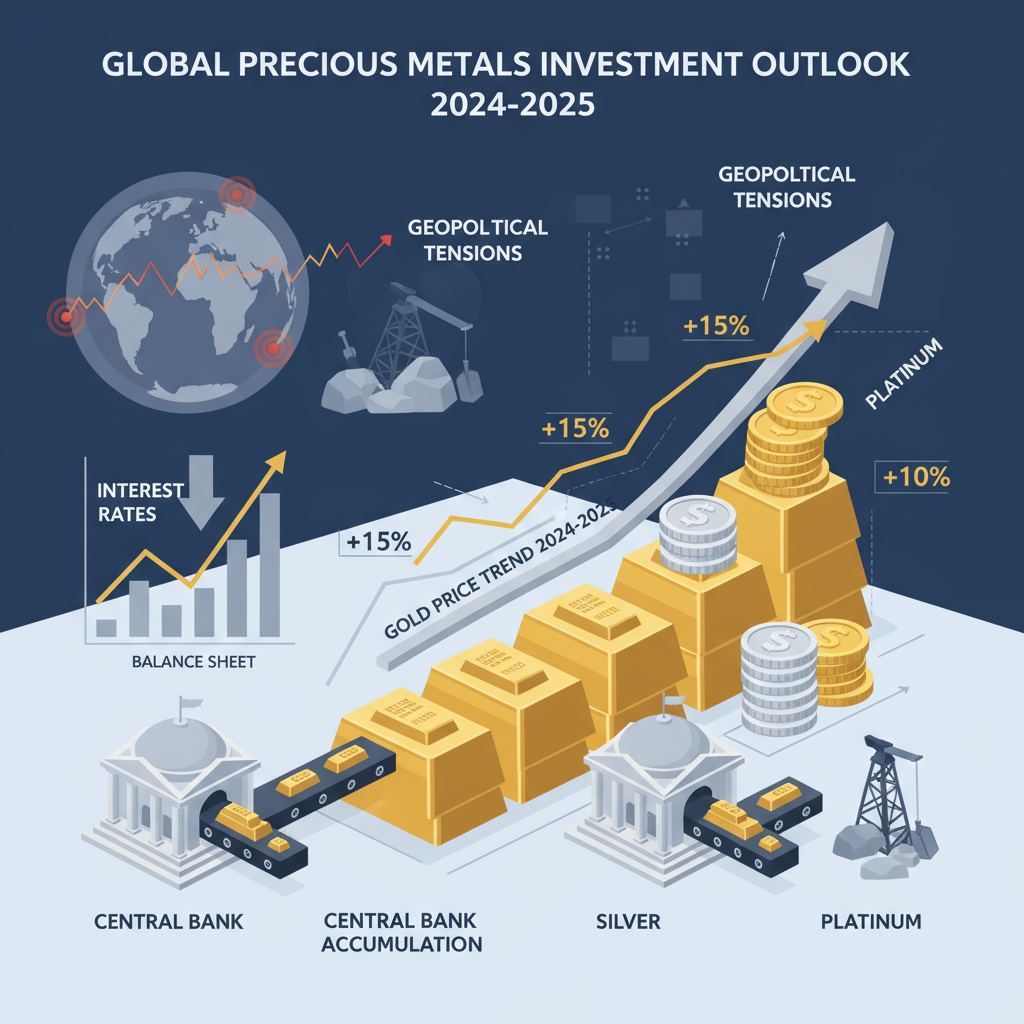

Gold has entered a significant bull market in 2024-2025, driven by economic policies, geopolitical tensions, and central bank reserve diversification. This surge has boosted investor interest not only in gold but also in silver and platinum. However, market volatility and supply constraints make timing gold sales challenging. Central banks' steady accumulation of gold limits supply and supports prices, while monetary policies like rate cuts further boost gold’s appeal by lowering real interest rates. The bull market is also reflected in rising gold mining stocks, though these come with operational risks. Besides gold, silver and platinum are gaining prominence due to their industrial uses and ties to green technologies. Overall, gold remains a key safe-haven asset amid global uncertainties, but investors must carefully navigate market fluctuations to optimize returns.

Summary

Navigating the Complex Landscape of Gold Investing Amid a New Bull Market

Gold has entered a prominent bull market phase in 2024-2025, spurred by a confluence of economic policies, geopolitical tensions, and strategic reserve diversification by central banks. This period of rising prices and heightened demand has reignited investor interest in precious metals, not only gold but also silver and platinum. However, the unique dynamics governing supply constraints and market volatility make timing the sale of gold investments particularly challenging.

The Challenges of Timing Gold Sales in a Volatile Market

Market volatility, driven by inflationary pressures, trade conflicts, and geopolitical uncertainties, complicates decisions regarding the appropriate timing to sell gold assets. Despite gold reaching record price levels, fluctuations remain common, making it difficult for investors to optimize returns. The gold market is influenced heavily by safe-haven demand, especially during periods of geopolitical tension, which often supports prices and prompts sustained interest from gold ETFs and institutional holders.

Central Bank Accumulation and Its Impact on Gold Prices

Central banks play a pivotal role in shaping the gold market by steadily accumulating gold reserves as part of their strategy to diversify away from the US dollar. This strategic shift reduces gold available in the open market, effectively constraining supply and contributing to upward price momentum. Additionally, policies such as rate cuts and the expansion of central bank balance sheets create an environment conducive to gold price appreciation by lowering real interest rates and diminishing the opportunity cost of holding non-yielding bullion.

Early Bull Market Signals Amplified by Mining Stocks

The current gold bull market is underscored by not only rising bullion prices but also by leveraged gains in gold mining stocks. These stocks provide investors with amplified exposure to gold’s upward trajectory but come with increased operational risks tied to mining productivity, geological challenges, and fluctuating ore grades. As natural limitations like declining ore grades constrain supply growth, mining companies face challenges in sustaining output, adding complexity to investment decisions.

Economic Policies and Their Influence on Precious Metals

Monetary policy decisions, notably interest rate adjustments and balance sheet expansions by central banks, significantly impact the gold market. Lowering interest rates tends to weaken real interest rates, which historically benefits gold as a safe-haven asset. Inflation concerns further strengthen gold’s appeal since the metal serves as a store of value when fiat currencies face depreciation. This macroeconomic backdrop not only supports gold but also extends to other precious metals such as silver and platinum, which are experiencing price rallies partly due to increased industrial demand linked to green technologies.

Beyond Gold: The Role of Silver and Platinum

While gold remains the cornerstone of precious metals investment during times of economic uncertainty, silver and platinum play increasingly important roles in the current market landscape. Silver’s dual appeal as both a store of value and an industrial metal positions it uniquely amid the precious metals rally, especially with applications in renewable energy and electronics. Similarly, platinum benefits from green technology trends, further diversifying opportunities within the precious metals sector.

Conclusion

The gold market’s current bull phase reflects a complex interplay of geopolitical, economic, and supply-side factors. Central bank accumulation, shifting monetary policies, and natural supply constraints all contribute to sustained price support, while the growing role of precious metals like silver and platinum adds further dimension to the market. For investors, timing the sale of gold remains a nuanced challenge, requiring careful consideration of market volatility and broader economic signals. As global dynamics evolve, gold’s status as a safe-haven asset and a vehicle for dollar diversification will likely continue to underpin its market relevance in the years ahead.

Frequently Asked Questions

Q: When to sell gold

A: The best time to sell gold depends on market conditions and personal financial goals. Generally, consider selling when gold prices are high compared to your purchase price, or during periods of economic uncertainty when gold typically commands a premium. It's also wise to evaluate your need for liquidity and investment portfolio balance. Monitoring market trends and consulting with financial advisors can help determine an optimal selling time.

Q: Gold bull market analysis

A: A gold bull market refers to a sustained period where gold prices are rising, often driven by factors like economic uncertainty, inflation fears, currency depreciation, or increased demand for safe-haven assets. Analysts study trends such as geopolitical tensions, central bank policies, and real interest rates to predict gold's performance. Technical indicators and historical data also help identify entry and exit points for investors. Understanding these dynamics can guide investment decisions during periods of rising gold prices.

Q: Gold mining stocks performance

A: Gold mining stocks often reflect both the price of gold and operational factors specific to mining companies. Their performance can be volatile, influenced by gold prices, production costs, geopolitical events, and market sentiment. Historically, they tend to perform well during periods of economic uncertainty or inflation, as investors seek safe-haven assets. However, individual stock performance can vary widely depending on company management, exploration success, and cost efficiency.

Q: Central bank gold reserves trends

A: Central bank gold reserves trends have shown a resurgence in recent years as several countries have increased their holdings to diversify reserves and hedge against currency fluctuations. Emerging economies, particularly in Asia, have been major buyers, while traditional holders like the United States and Germany maintain large but relatively stable reserves. This trend reflects growing concerns about economic uncertainty and geopolitical risks, prompting central banks to reinforce their gold assets as a safe haven. Overall, global gold reserves have been gradually rising since the early 2010s.

Q: Best gold dealers UK

A: The best gold dealers in the UK are known for their reliability, transparency, and competitive pricing. Reputable dealers include The Royal Mint, BullionByPost, and GoldCore, all of which offer a range of investment-grade gold products. It's important to choose dealers that are authorized, have positive customer reviews, and provide secure storage options if needed. Comparing prices and checking for certifications can help ensure a safe and satisfactory transaction.

Key Entities

Semler Scientific: Semler Scientific is a medical technology company specializing in non-invasive blood testing devices. The company develops handheld devices that measure hemoglobin levels quickly and painlessly at the point of care.

The Pure Gold Company: The Pure Gold Company is a Canadian gold mining firm operating primarily in the Red Lake Mining District in Ontario. It focuses on advancing exploration and development of its mineral properties to increase gold production.

ECB: The European Central Bank (ECB) is the central bank for the euro and manages monetary policy for the Eurozone. It aims to maintain price stability and supports the economic policies of the European Union.

Reuters: Reuters is a global news organization providing real-time news and information on financial markets, business, and current events. It is known for its independent journalism and extensive international coverage.

Stifel Wealth Management: Stifel Wealth Management is a division of Stifel Financial Corp offering personalized investment advisory services to individual and institutional clients. The firm provides comprehensive financial planning and asset management solutions.

External articles

- How to Know When the Precious Metals Pullback Is Over

- Gold: A Multi-Year Bull Run Is Now My Base Case

- Gold's Golden Ascent: A Record-Breaking Rally Defies Slump ...

Articles in same category

- China's Gold Reserves: Transparency, Strategy, and Global Economic Impact

- Cryptocurrency Risks and Safe Haven Investments: From Crashes to Gold & Silver

- China’s Strategic Gold Reserves Impact Global Precious Metals Markets

YouTube Video

Title: Junior Gold Stock Bull Market Strategies with Dave Kranzler

Channel: MiningStockEducation.com

URL: https://www.youtube.com/watch?v=ZiE3uMjhmZQ

Published: 5 days ago

Finance