December 2025 Market Pulse: Fed Rate Cut Hopes, Retail Strength, and Energy Trends

As December unfolds, strong retail sales and cautious investor sentiment shape the market landscape.

Despite a 9.4% rise in online Black Friday sales, U.S. futures dipped slightly after a five-day rally.

Anticipation of a possible Fed rate cut, now with an 84.9% chance, fuels cautious optimism amid volatility.

OPEC+ paused production increases, pushing oil prices higher and stirring energy markets.

Tech stocks face volatility after major partnerships, though Dell sees gains from AI server demand.

Retailers navigate challenges despite holiday sales expected to exceed $1 trillion.

The S&P 500 approaches record highs, reflecting resilience amid uncertainty.

Read more:

perplexity.aiSummary

Market Pulse December 2025: A Tale of Bullish Surges and Subtle Storms

As December unfurls its wintery cloak, the financial world is humming a complex tune—one that balances strong retail signals and cautious investor sentiment. Despite an impressive 9.4% year-over-year leap in online Black Friday sales, U.S. stock futures took a modest step back on December 1st, 2025. The S&P 500, Dow, and Nasdaq futures dipped by roughly 0.5% to 0.74%, pausing after a spirited five-day rally over Thanksgiving. Investors, it seems, are holding their breath, waiting for the next beat of economic data and the Federal Reserve’s next move.

The underlying theme? Anticipation of a possible Fed rate cut has taken center stage. Market watchers now price in an 84.9% chance of a 25-basis-point reduction this month, a figure more than twice what it was just a week earlier. Dovish whispers from Fed officials and rumors swirling about leadership reshuffling have fanned hopes of easing monetary policies. This expectation is acting like a quiet undercurrent beneath the surface of market activity, driving cautious optimism amid broader volatility.

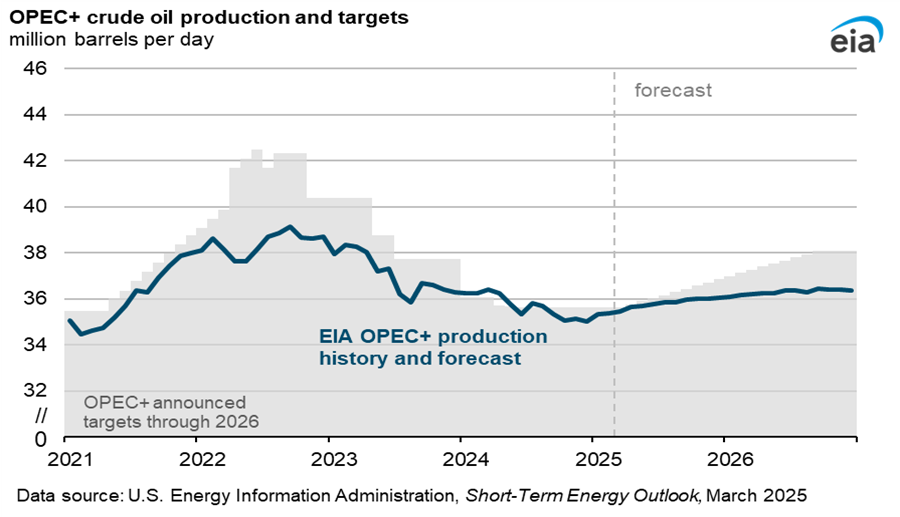

Energy markets have joined the drama with a decisive plot twist as OPEC+ announced a pause on production increases for the first quarter of 2026. This move nudged oil prices higher, stirring the energy sector and hinting at potential supply constraints that traders are now keenly recalibrating around. It’s a reminder that geopolitical and resource dynamics remain an unpredictable force in global markets.

The technology sector, however, remains a patchwork of contrasts. Volatility continues to rock tech stocks amid fierce competition in the AI chip space, particularly after a headline-grabbing partnership between Alphabet and Meta. Giants like Nvidia and AMD saw their shares dip, reflecting broader anxieties that have pushed the S&P 500’s tech index down by 6% over the past month. Yet there’s a silver lining: Dell Technologies surprised on the upside with strong demand for AI data center servers, boosting its shares by 3.6% and offering a glimmer of hope in an otherwise turbulent tech landscape.

Retail, the perennial heart of holiday cheer, is wrestling with fresh challenges. Despite the National Retail Federation's projection of holiday sales surpassing a historic $1 trillion milestone, tariff pressures and waves of layoffs are clouding consumer confidence. Retailers like Walmart and Target present a mixed bag, encapsulating a sector navigating both opportunity and headwinds as shoppers tighten their belts.

Finally, the broader market narrative finds the S&P 500 near record territory, recovering from earlier tariff-induced declines. The rally signals resilience but leaves underlying questions about tech valuations and economic growth looming large.

In sum, December 2025 shapes up to be a month where the promise of easing policies, robust retail performance, and energy market recalibrations will all jockey for position. For investors and observers alike, it’s a dynamic canvas—painted with strokes of optimism and caution—that demands attention and agility.

Questions and answers

Q: December 2025 stock market outlook

A: The December 2025 stock market outlook suggests moderate gains driven by seasonal holiday spending and potential easing of inflation pressures. Investors will closely watch corporate earnings reports and any Fed policy adjustments as key influencers. Geopolitical tensions and economic data releases could introduce volatility, but overall market sentiment is cautiously optimistic.

Q: Impact of Fed rate cut on stocks

A: A Federal Reserve rate cut generally boosts stock markets by lowering borrowing costs, encouraging business investment and consumer spending. It often signals a supportive monetary policy stance, which can increase investor confidence. However, if the cut reflects economic weakness, markets may react mixed depending on broader economic conditions and investor sentiment.

Q: OPEC+ production pause effects

A: An OPEC+ production pause typically stabilizes oil supply, supporting global oil prices if demand remains steady. This can benefit energy sector stocks but may increase production costs for industries reliant on oil. The pause can also impact inflation rates and influence central bank policy decisions depending on how it affects broader economic activity.

Q: Technology sector volatility December 2025

A: Technology sector volatility in December 2025 is expected due to mixed earnings results, regulatory developments, and shifting investor sentiment toward growth versus value stocks. Rapid innovation cycles and supply chain constraints may also contribute to price swings. Despite volatility, long-term growth prospects for key tech companies remain strong.

Q: Retail sales performance holiday 2025

A: Holiday retail sales in 2025 are projected to grow moderately, supported by robust consumer spending and a recovering job market. E-commerce is expected to continue gaining share, while supply chain improvements could reduce inventory shortages. Promotional activity and inflation trends will influence overall sales performance during this critical period.

Key Entities

Federal Reserve: The Federal Reserve is the central banking system of the United States, responsible for setting monetary policy and regulating banks. It plays a crucial role in managing inflation and supporting economic stability.

OPEC+: OPEC+ is an alliance of oil-producing countries that coordinates petroleum production to influence global oil prices. It includes members of the Organization of the Petroleum Exporting Countries plus additional producers such as Russia.

Alphabet: Alphabet is the parent company of Google, overseeing various technology ventures including search, advertising, and artificial intelligence. It is a leading player in global digital innovation and data services.

Meta: Meta Platforms, formerly Facebook, is a social media and technology company focusing on virtual reality and the metaverse. It operates major platforms like Facebook, Instagram, and WhatsApp.

Dell Technologies: Dell Technologies is a multinational corporation specializing in computer hardware, software, and IT services. It provides solutions for personal computing, data storage, and enterprise infrastructure.

External articles

- The Fed Explained - Monetary Policy

- Federal Reserve Board - Monetary Policy

- Monetary Policy: Stabilizing Prices and Output

Articles in same category

- Frontline (FRO) Valuation and Growth Amid Rising Oil Demand

- CRISPR Therapeutics Unveils Promising AATD Gene Editing Data

- Aston Martin Issues Profit Warning on Tariff Impact

YouTube Video

Title: S&P Holds Despite Recession Signals | ISM Crash, Fed Cut Odds & What Traders Should Watch

URL: https://www.youtube.com/shorts/EsZCrZGDoxk

Money