Cyprus Tax Residency Rules and Benefits for Passive Income Investors

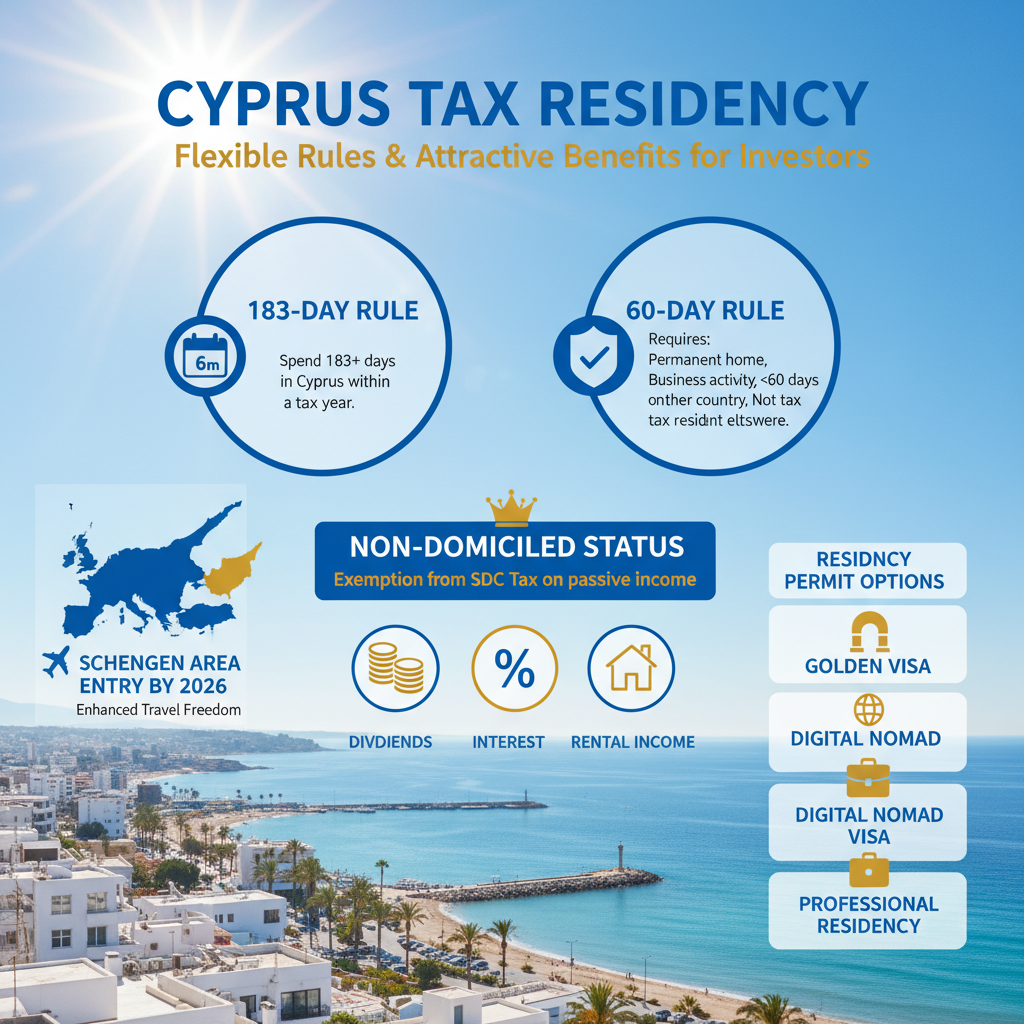

Cyprus offers a highly flexible and attractive tax residency framework, ideal for investors aiming to optimize taxation on passive income. The country provides two main tax residency routes: the 183-day rule and the more flexible 60-day rule, each with specific criteria allowing tailored residency options. A significant benefit is the non-domiciled status, which exempts eligible residents from Special Defence Contribution (SDC) tax on worldwide passive income, including dividends and interest. Despite ending its Citizenship-by-Investment program in 2020, Cyprus continues to offer robust tax residency incentives. Additionally, Cyprus's upcoming entry into the Schengen area by 2026 will enhance travel freedom for residents. With various residency permits, including Golden Visas and Digital Nomad options, Cyprus remains a top choice for financially independent individuals seeking tax efficiency and a strategic European base.

Summary

Cyprus Tax Residency: Flexible Rules and Attractive Benefits for Investors

Cyprus has established itself as a highly favorable jurisdiction for tax residency, particularly for investors seeking to optimize taxation on passive income. Offering flexibility through two main tax residency rules, alongside a beneficial non-domiciled status, Cyprus attracts financially independent individuals by combining low physical presence requirements with significant tax exemptions. Moreover, upcoming changes such as Cyprus’s anticipated entry into the Schengen area by 2026 are set to enhance travel freedom, further increasing the appeal of its residency programs.

Tax Residency Rules: The 183-Day and 60-Day Pathways

Cyprus permits individuals to acquire tax residency via two distinct routes:

- 183-Day Rule: A straightforward requirement where an individual spends at least 183 days in Cyprus within a tax year.

- 60-Day Rule: A more flexible option allowing residency with a minimum stay of 60 days, provided certain strict criteria are met. These include not being tax resident in any other country, maintaining a permanent home in Cyprus (owned or rented), conducting business activities or holding a professional office in Cyprus, and not exceeding 183 days in any other single jurisdiction.

Both routes ensure that investors can tailor their presence based on personal or business priorities, optimizing the balance between tax obligations and lifestyle considerations.

Non-Domiciled Status and Special Defence Contribution (SDC) Tax Exemptions

A crucial advantage of Cyprus tax residency lies in the non-domiciled (non-dom) regime. Eligible residents who have not been domiciled or tax resident in Cyprus for at least 17 of the preceding 20 years can benefit from exemption from the Special Defence Contribution (SDC) tax on passive income. This includes dividends, interest, and rental income, regardless of whether these incomes are generated inside or outside Cyprus. As such, non-dom residents effectively eliminate SDC liabilities on worldwide passive income.

Currently, rental income is subject to both income tax and SDC; however, planned tax reforms for 2026 aim to simplify this framework and potentially remove SDC charges on rental income, further enhancing tax efficiency for investors.

Sustained Attractiveness Despite Citizenship Program Closure

Although Cyprus terminated its Citizenship-by-Investment program in 2020, this development did not affect the attractiveness or availability of its tax residency incentives. The strong tax residency regime and the non-dom benefits remain fully operational, continuing to appeal to investors interested in efficient tax planning and residency benefits.

Residency and Travel Benefits Linked to EU Membership and Schengen Entry

Cyprus is an EU member state, and its anticipated inclusion in the Schengen area by 2026 is expected to significantly improve travel mobility for its residents. This enhanced travel freedom will raise the value of Cyprus residency programs by facilitating easier movement throughout much of Europe, thereby making Cyprus an even more strategic location for investors and expatriates.

Diverse Residency Permit Options Supporting Investment and Financial Independence

Beyond tax residency, Cyprus provides multiple residency pathways aligned with investor needs, including:

- Golden Visa Programs: Residency linked to real estate investment or proof of financial independence through passive income.

- Digital Nomad Visas: Designed for remote workers meeting minimum income thresholds, enabling flexible residency without traditional employment constraints.

- Professional and Business Residency Options: Catering to entrepreneurs and investors aligning with Cyprus’s economic goals.

Compliance Requirements to Secure Valid Tax Residency

To confirm bona fide tax residency under the 60-day rule, applicants must fulfill key compliance requirements. Maintaining a permanent residence in Cyprus, demonstrating economic or business ties within the country, and holding a Cypriot bank account are essential for establishing genuine residency. These measures help ensure compliance with local tax laws and international standards, safeguarding the integrity of the tax residency status.

Conclusion

Cyprus presents a highly adaptable and advantageous framework for tax residency, particularly suited to passive income investors and financially independent individuals. With the dual tax residency rules, generous non-domiciled exemptions from the SDC tax, and upcoming enhancements in travel freedom due to Schengen integration, Cyprus stands out as one of the most efficient EU jurisdictions for tax planning as of 2025. Prospective investors and expatriates can leverage these benefits alongside various residency options to establish a robust and tax-efficient presence in the region.

Frequently Asked Questions

Q: Cyprus tax residency benefits 2025

A: Cyprus tax residency in 2025 offers significant benefits including a favorable personal income tax regime with low tax rates, no tax on dividend and interest income for residents, and exemption from taxation on worldwide dividends and capital gains, except gains from immovable property situated in Cyprus. The country also offers access to a broad range of double taxation treaties. Additionally, individuals who qualify as tax residents can benefit from a non-domicile status, exempting them from certain taxes such as the special defense contribution on passive income.

Q: Cyprus non-dom tax regime explained

A: The Cyprus non-dom tax regime offers significant tax advantages to individuals who become tax residents of Cyprus but do not have domicile status in the country. Non-dom status provides exemptions from taxation on dividends, interest, and rental income earned abroad, allowing these incomes to be received tax-free in Cyprus. To qualify, an individual must be a tax resident but not domiciled in Cyprus, according to legal definitions. This regime is particularly attractive for international professionals and investors seeking a favorable tax environment.

Q: Compare Portugal and Cyprus tax incentives

A: Portugal offers attractive tax incentives such as the Non-Habitual Resident (NHR) regime, which provides reduced tax rates and exemptions for foreign income over a 10-year period, and various benefits for retirees and high-value professionals. Cyprus offers competitive corporate tax rates at 12.5%, exemptions on dividends and capital gains, and the Non-Domicile regime which provides significant tax relief for foreign pensioners and business owners. Both countries use tax incentives to attract foreign investment and retirees, but Portugal focuses more on individual income tax benefits, while Cyprus emphasizes corporate tax advantages and non-domicile exemptions.

Q: How to get Cyprus Golden Visa

A: The Cyprus Golden Visa is available through the country's Citizenship by Investment program, which requires making a significant investment in real estate, businesses, or government bonds. To qualify, applicants must invest at least €2 million in real estate or development projects and hold the investment for a stipulated period. Additionally, applicants must meet background and suitability checks and have a clean criminal record. The process involves submitting necessary documents, passing due diligence, and completing the investment within Cyprus guidelines.

Q: Impact of Schengen on Cyprus residency

A: Cyprus is not currently a member of the Schengen Area, so Schengen rules do not directly affect Cyprus residency permits. However, Cypriot residents can travel visa-free within Schengen countries for short stays of up to 90 days in any 180-day period, facilitating easier movement. Cyprus has expressed interest in joining Schengen, which could in the future simplify border controls and residency procedures for Cyprus residents. Until then, Cyprus residency is managed independently of Schengen regulations.

Key Entities

Cyprus: Cyprus is an island country in the Eastern Mediterranean known for its strategic location and rich history. The article references Cyprus in connection with European Union relations and regional developments.

European Union: The European Union is a political and economic union of 27 member states primarily located in Europe. The article discusses the EU’s policies and initiatives impacting member countries such as Cyprus and Portugal.

Eric Schmidt: Eric Schmidt is a prominent American businessman and former CEO of Google, known for his leadership in the technology sector. The article mentions Schmidt in relation to technology trends and innovation discussions.

Portugal: Portugal is a Southern European country on the Iberian Peninsula, recognized for its maritime heritage and membership in the European Union. The article highlights Portugal’s role in EU affairs and regional cooperation.

Limassol: Limassol is a major coastal city in Cyprus known for its port, tourism, and business centers. The article references Limassol in the context of economic activity and its significance within Cyprus.

External articles

- The Cyprus Tax Residency and the Cyprus Non-Dom ...

- Cyprus Tax Residency and Non-Dom rules

- Considering Cyprus as an alternative tax residency option ...

Articles in same category

- Naked Mole-Rats: Unraveling the Secrets of Eusociality and Longevity

- AI Hallucinations in Legal Practice: Court Sanctions Highlight Risks

- Controversy Surrounding AI Judging Tool at Canadian Brewing Awards

YouTube Video

Title: Tax Benefits of Moving Your Business to Cyprus 2025 | Non-Dom Explained

Channel: Paul & Tamar in Cyprus

URL: https://www.youtube.com/watch?v=8DLj1nL6tO8

Published: 3 weeks ago

Technology