XRP Price Forecast 2025-2030 and Ripple’s Strategic Expansion Impact

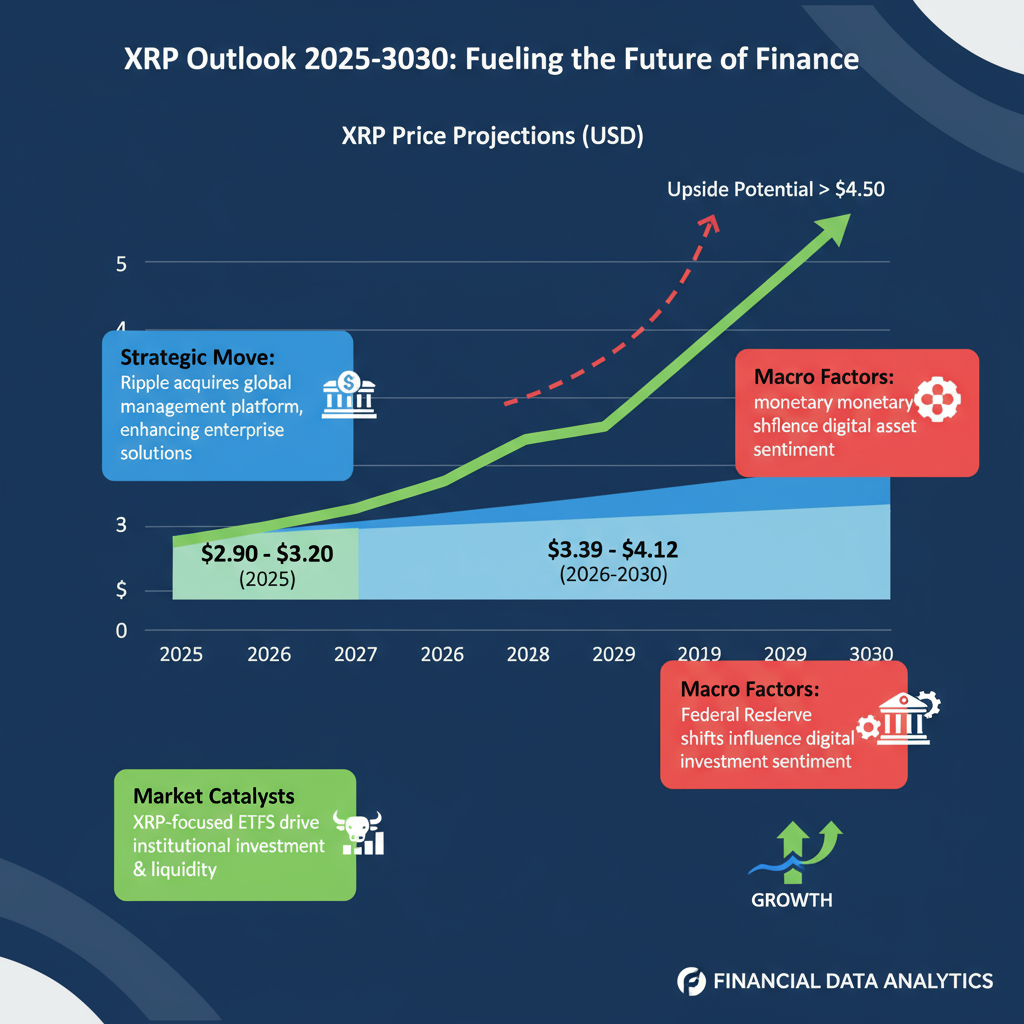

XRP is poised for notable growth between 2025 and 2030, driven by Ripple’s strategic initiatives and favorable market conditions. Price forecasts estimate XRP reaching $2.90 to $3.20 by 2025, with potential to exceed $4.50 if XRP-focused ETFs gain approval and the crypto market rallies. Ripple’s acquisition of treasury platform Gtreasury enhances its corporate payment infrastructure, likely boosting XRP adoption among institutional clients. Additionally, the introduction of XRP ETFs could attract significant institutional capital, improving liquidity and market confidence. Federal Reserve monetary easing further supports upward price momentum by increasing investor appetite for risk assets like XRP. Overall, these factors position XRP as a strong contender for sustained growth in the cryptocurrency sector over the coming years.

Summary

XRP Price Forecast and Ripple’s Strategic Expansion: Key Drivers for 2025-2030

XRP continues to capture attention in the cryptocurrency market due to its promising price outlook and Ripple’s strategic moves to broaden institutional adoption. Forecasts predict XRP could reach between $2.90 and $3.20 by the end of 2025, with potential to surge above $4.50 under favorable conditions such as approval of XRP-focused exchange-traded funds (ETFs) and a robust cryptocurrency market rally. This article examines XRP’s price projections through 2030, Ripple’s acquisition of treasury management platform Gtreasury, and other market dynamics shaping XRP’s future.

XRP Price Projections for 2025-2030

Analysts estimate XRP will experience moderate growth, with expected price levels ranging from $3.39 to $4.12 over the 2026-2030 period. These projections assume continued adoption within institutional and corporate sectors and a supportive crypto market environment. Bullish forecasts hinge on potential approval of XRP ETFs, which are anticipated to attract between $3 billion and $10 billion in institutional capital. This influx could increase liquidity, enhance market confidence, and significantly influence XRP price momentum.

Ripple’s Acquisition of Gtreasury: Enhancing Corporate Treasury Payments

Ripple’s strategic acquisition of Gtreasury, a treasury management platform, underscores its commitment to expanding financial technology infrastructure. Integration of Gtreasury’s solutions is expected to improve RippleNet’s corporate treasury payments and liquidity management capabilities. This development positions Ripple to better serve institutional clients managing cross-border payments and corporate liquidity needs, potentially broadening XRP’s adoption. Enhanced treasury functionalities could indirectly support XRP price growth by increasing demand tied to fundamental treasury operations.

Role of XRP-Focused ETFs in Institutional Investment

The potential approval of XRP-focused ETFs represents a critical catalyst for institutional capital inflows. ETFs would open pathways for large-scale asset managers and investors to gain regulated exposure to XRP, fostering greater market participation. The resulting institutional investment is projected to drive price appreciation by improving both liquidity and market sentiment. Conversely, regulatory delays or rejection of these ETFs could hamper growth and contribute to volatility in XRP’s price.

Impact of Federal Reserve Monetary Policy on Cryptocurrency Markets

Federal Reserve monetary easing, particularly interest rate cuts, positively impacts risk assets including cryptocurrencies. Lower rates enhance liquidity conditions and boost investor appetite for higher-yielding assets such as XRP. This easing helps mitigate market volatility and supports upward price trends across the crypto sector. Coupled with favorable ETF developments and Ripple’s expansion efforts, monetary policy tailwinds have the potential to strengthen XRP market momentum through 2025 and beyond.

Market Sentiment, Volatility, and XRP Adoption Strategies

XRP’s price dynamics reflect broader market sentiment and regulatory environments governing cryptocurrency markets. Ripple’s ongoing efforts to increase XRP adoption in financial institutions focus on reinforcing cross-border payment infrastructure and leveraging RippleNet’s network efficiency. By addressing challenges in corporate treasury management and liquidity, Ripple aims to solidify XRP’s role as a practical asset in institutional finance, which could sustain long-term price stability and growth.

Conclusion

XRP’s price forecast for 2025-2030 is shaped by a combination of strategic acquisitions, regulatory developments, and macroeconomic factors. Ripple’s Gtreasury acquisition enhances its financial technology platform, supporting greater corporate treasury payment solutions that underpin XRP’s utility and demand. The anticipated approval of XRP-focused ETFs stands to channel substantial institutional capital, while Federal Reserve monetary easing provides additional support through improved liquidity. Together, these factors establish a solid foundation for XRP’s potential price appreciation to the $2.79–$3.20 range by 2025, with upside to $4.50 or beyond under favorable market conditions. As Ripple continues to expand XRP adoption across institutional finance, XRP remains a crypto asset to watch in evolving market landscapes.

Frequently Asked Questions

Q: How high can XRP price go before 2025 ends

A: Predicting the exact price of XRP before the end of 2025 is challenging due to market volatility and regulatory factors. XRP's price depends on factors like adoption of Ripple's technology, regulatory developments, overall cryptocurrency market trends, and global economic conditions. Optimistic forecasts suggest potential significant growth if Ripple succeeds in expanding its use cases and resolving legal matters. However, investors should consider risks and conduct thorough research before making decisions.

Q: XRP price prediction 2025

A: Predicting the price of XRP in 2025 involves considering factors like market trends, adoption of Ripple's technology, regulatory developments, and overall cryptocurrency market conditions. While some analysts are optimistic, suggesting potential growth if Ripple expands its partnerships and resolves legal issues, others warn of volatility and risks. As with all cryptocurrencies, XRP's price can be unpredictable, so investors should approach with caution and conduct thorough research.

Q: Impact of XRP ETFs on price

A: The introduction of XRP Exchange-Traded Funds (ETFs) can significantly influence the price of XRP by increasing investor accessibility and demand. ETFs allow investors to gain exposure to XRP without directly purchasing the cryptocurrency, potentially attracting a broader range of institutional and retail investors. This increased demand can drive the price upward. However, market sentiment, regulatory environment, and overall crypto market trends also play crucial roles in determining the actual price impact.

Q: Ripple acquisition of Gtreasury details

A: Ripple, a leading blockchain and payment solutions company, acquired Gtreasury to enhance its treasury management capabilities. Gtreasury is a cloud-based treasury and risk management platform that helps organizations optimize liquidity, risk, and payments. This acquisition aims to integrate Gtreasury’s advanced cash and risk management technology with Ripple's blockchain solutions, providing clients with improved payment workflows and financial operations. The move strengthens Ripple’s position in offering comprehensive financial infrastructure for enterprises worldwide.

Q: Effect of Fed rate cuts on cryptocurrency prices

A: Federal Reserve rate cuts generally lower borrowing costs and increase liquidity in the economy, which can lead investors to seek higher returns in alternative assets like cryptocurrencies. As a result, rate cuts often boost demand and drive up cryptocurrency prices. However, the impact can vary due to other market factors and investor sentiment toward digital assets.

Key Entities

Ripple: Ripple is a technology company specializing in real-time gross settlement systems and remittance networks using blockchain technology. It is known for developing the RippleNet payment network that facilitates cross-border transactions.

XRP: XRP is the native digital asset used within RippleNet to facilitate fast and low-cost international payments. Unlike many cryptocurrencies, XRP does not rely on mining, enabling quicker transaction confirmations.

Gtreasury: Gtreasury is a treasury management software company that provides tools for cash management, risk mitigation, and payments automation. The company integrates with blockchain solutions to enhance corporate liquidity operations.

Egrag Crypto: Egrag Crypto appears to be a cryptocurrency-related entity, possibly involved in digital asset services or trading. However, specific verified information about Egrag Crypto is limited or unavailable.

Dark Defender: Dark Defender is presumably a cybersecurity solution focused on protecting digital assets and networks from cyber threats. It may play a role in securing blockchain or cryptocurrency infrastructures.

External articles

- XRP (XRP) Price Prediction 2025 2026 2027 - 2030

- XRP Forecast for 2025, 2026, 2027 – 2030

- Will XRP Hit $5? Three Scenarios for the 2025 Bull Run

Articles in same category

- Bitcoin Core v30 Update Expands OP_RETURN Data Capacity Amid Community Debate

- China’s Rare Earth Export Controls Escalate US-China Trade War and Impact Crypto Markets

- OpenAI's Trillion Dollar AI Investment Strategy for Market Leadership

YouTube Video

Title: Ripple’s $1B Move Into the $120 Trillion Treasury Market 💸

URL: https://www.youtube.com/shorts/vn9iPAnMfH0

Crypto