Norway’s Economic Transition: Managing Fiscal Sustainability Amid Demographic and Oil Challenges

Norway is facing a significant economic transition as rising state expenses, driven by an aging population and declining oil revenues, are set to surpass government revenues. The nation’s traditional reliance on petroleum wealth and its sovereign wealth fund is waning, prompting the government to implement fiscal reforms focused on tax restructuring, healthcare efficiency, and strengthened local government funding. Despite global uncertainties, Norway aims to sustain moderate economic growth while managing demographic pressures and shifting towards a more diversified economy. Balancing social welfare needs, environmental sustainability, and fiscal discipline remains central to securing Norway’s long-term economic resilience.

Summary

Norway’s Economic Transition: Navigating Fiscal Sustainability Amid Demographic and Oil Sector Challenges

Norway stands at a pivotal economic crossroads as state expenses are projected to surpass revenues in coming years. This shift is largely driven by demographic changes, notably an aging population, and declining oil revenues, signaling the end of an era where petroleum wealth powered large fiscal surpluses. In response, the Norwegian government is prioritizing fiscal sustainability through targeted reforms in taxation, healthcare management, and local government funding. This article explores the key aspects of Norway’s economic transition and the policy responses shaping its future.

Rising State Expenses and Demographic Changes

The demographic profile of Norway is changing significantly, with increased life expectancy and a growing elderly population placing considerable pressure on social services and healthcare expenditures. The aging population demands more extensive healthcare and social support, contributing to rising state expenses. These demographic shifts, combined with structural economic changes, require the government to carefully manage public spending to maintain fiscal balance.

Declining Oil Revenues and Sovereign Wealth Fund Pressures

Norway’s fiscal sustainability has long relied on revenues from its petroleum sector, which have funded the nation’s extensive welfare state and a robust sovereign wealth fund. However, recent declines in oil revenues and reduced petroleum investment have intensified pressures on state finances. As oil income falls, withdrawals from the sovereign wealth fund are likely to increase, underscoring the urgency for prudent fiscal reforms that ensure long-term economic stability without eroding financial reserves.

Government Strategies: Tax Reform, Healthcare, and Local Funding

To address mounting budgetary challenges, the Norwegian government is focusing on comprehensive tax reform aimed at securing stable and predictable revenues in a post-oil economy. Equally important are healthcare reforms designed to enhance efficiency and cost control within this vital sector. Improving healthcare management is critical in light of demographic realities and escalating expenditure trends.

Moreover, the government is aiming to bolster funding and governance structures for local governments, enabling them to effectively meet service demands while maintaining balanced budgets. This localized approach supports broader fiscal discipline and ensures social services continue to meet the needs of communities across Norway.

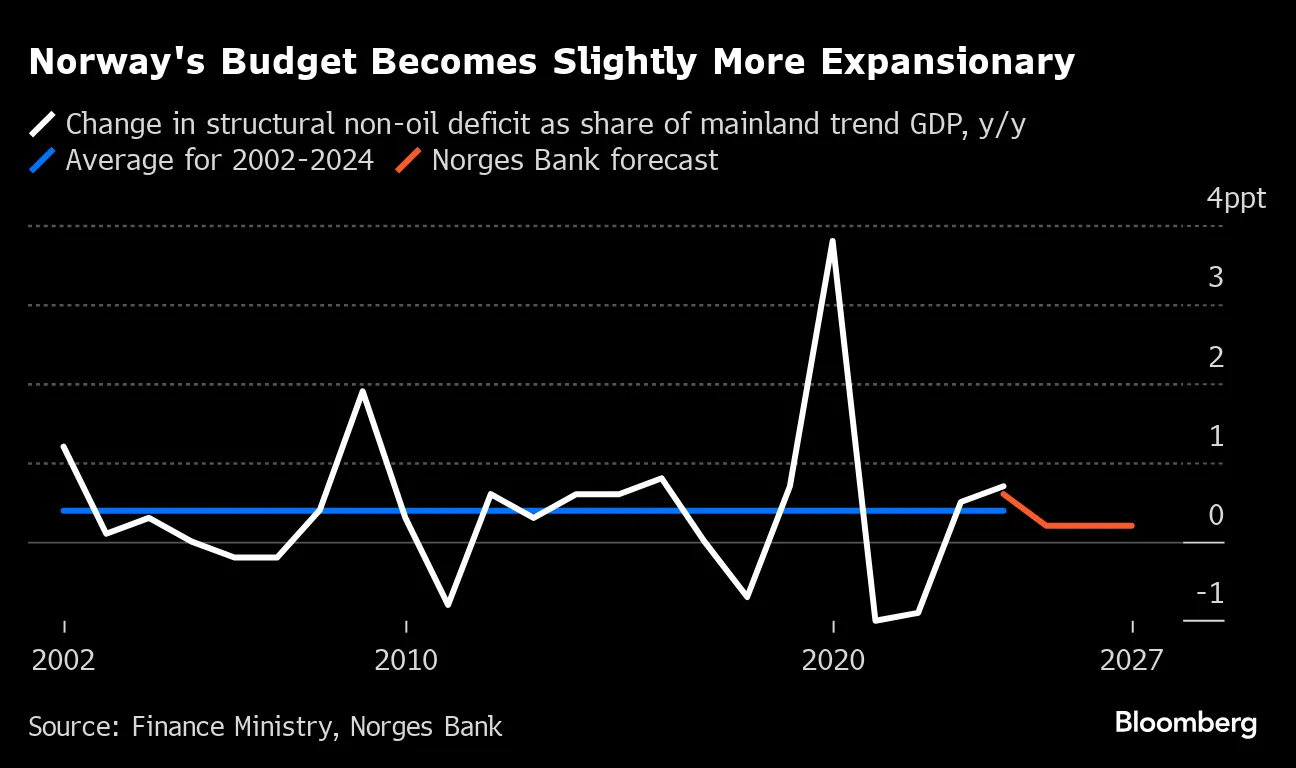

Economic Outlook and Employment Dynamics

Despite global uncertainties, including inflationary pressures and geopolitical risks, Norway’s economic growth is expected to moderate but remain positive, with mainland GDP projected to grow between 1.5% and 2% in 2025. The employment-to-population ratio is anticipated to improve as the labor force expands faster than the working-age population, although current unemployment rates have seen a modest increase. These labor market dynamics reflect the country’s ongoing shift from an oil-centered economy toward a more diversified and resilient economic model.

Political Debate and Defense Spending Considerations

Norway’s parliamentary discussions reflect the complexity of balancing fiscal priorities amid evolving domestic and global challenges. Defense spending is a prominent topic, influenced by geopolitical tensions and Norway’s commitments to European partners. Budget allocations must reconcile security needs with the demands of social welfare programs and fiscal discipline, adding another layer to the national economic debate.

Environmental Policy Intersections

While direct details on nature-related policies in the latest budget deliberations are limited, environmental concerns remain intertwined with economic and fiscal policy discussions. Norway’s commitment to sustainability continues to influence its approach to economic diversification and state expenditure planning, ensuring environmental objectives are integrated alongside social and fiscal goals.

Conclusion

Norway’s shift from an oil-driven economic surplus to a more diversified economy presents significant fiscal challenges amid demographic shifts and declining petroleum revenues. The government’s focus on tax reform, healthcare efficiency, and enhanced local government funding constitutes a multi-faceted strategy to safeguard fiscal sustainability. As Norway navigates this complex transition, balancing social welfare demands, environmental commitments, and fiscal discipline will be essential for maintaining economic resilience in the years ahead.

Frequently Asked Questions

Q: Norwegian state budget debate 2024

A: The Norwegian state budget debate for 2024 involves discussions in the Norwegian Parliament (Stortinget) regarding government expenditures, revenues, and fiscal policies for the year. Key topics often include allocations for social welfare, infrastructure, education, and climate initiatives, reflecting Norway's priorities. The debate provides an opportunity for political parties to present their positions and suggest amendments before the budget is finalized and implemented.

Q: Impact of oil revenue decline on Norway economy

A: A decline in oil revenues significantly affects Norway's economy, as the country relies heavily on income from its petroleum sector. Reduced oil income can lead to lower government revenues, which may impact public spending and investments in social programs. However, Norway's substantial sovereign wealth fund, financed by previous oil profits, helps cushion the economy against such shocks by providing a financial buffer and enabling continued fiscal stability. Additionally, the government often uses this period to accelerate diversification efforts toward renewable energy and other industries to reduce dependence on oil in the long term.

Q: Tax reform proposals in Norway

A: Tax reform proposals in Norway often focus on adjusting income taxes, corporate taxes, and value-added tax (VAT) to promote economic growth and social equity. Recent discussions have included proposals to simplify the tax code, enhance environmental taxes to support sustainability, and improve tax incentives for innovation and investment. The Norwegian government regularly consults with policymakers and stakeholders to balance competitiveness with the welfare state model. These reforms aim to ensure a fair distribution of tax burdens while sustaining public services.

Q: Norway healthcare system reforms

A: Norway's healthcare system has undergone several reforms aimed at improving efficiency, quality, and accessibility. Key reforms include the 2002 hospital reform, which transferred ownership of hospitals from counties to the central government to streamline management. More recent efforts focus on integrating services, enhancing primary care, and increasing digitalization to provide patient-centered care. These reforms strive to balance high-quality universal healthcare with cost containment and sustainability.

Q: Norwegian sovereign wealth fund and budget

A: Norway's sovereign wealth fund, officially called the Government Pension Fund Global, is one of the world's largest state-owned investment funds. It was established to manage surplus revenues from Norway's petroleum sector, aiming to secure wealth for future generations. The fund plays a crucial role in the national budget by providing financial support; each year, the government uses a small, sustainable portion of the fund's expected returns—typically around 3%—to finance public spending without depleting the principal. This approach helps stabilize the economy and maintain fiscal discipline while investing proceeds from oil revenues for long-term national benefit.

Key Entities

Norwegian Parliament: The Norwegian Parliament, known as the Storting, is Norway's supreme legislative body responsible for enacting laws and approving the national budget. It plays a central role in shaping the country's policies, including those related to finance and governance highlighted in the article.

Norway: Norway is a Nordic country known for its robust social welfare system and wealth derived largely from natural resources like oil and gas. The article involves Norway's political landscape, where government decisions influence economic and fiscal policies.

finance ministry: Norway's finance ministry oversees the country's economic policy, budgeting, and financial regulation. In the article context, it is key to managing the nation's fiscal matters discussed by political leaders.

Prime Minister Jonas Gahr Støre: Jonas Gahr Støre is the current Prime Minister of Norway, leading the Labour Party and the government. His leadership is central to the political discourse and decisions involving Norway's fiscal and policy directions noted in the article.

Progress Party: The Progress Party is a Norwegian political party known for its conservative and libertarian positions, particularly on immigration and economic issues. It serves as an opposition force in Norwegian politics, interacting with the government in debates on budget and policy matters.

External articles

- IMF Executive Board Concludes 2025 Article IV ...

- how wealth tax became a battleground in Norway's election

- Norway: Staff Concluding Statement for the 2025 Article IV ...

Articles in same category

- Kristian Berg Harpviken Named Director of Norwegian Nobel Institute: Shaping the Future of the Nobel Peace Prize

- The Norwegian Parliament Opens with Royal Tradition Amid Political Shifts Following 2025 Election

- Norwegian Government Cancels Stad Ship Tunnel Project Amid Rising Costs

YouTube Video

Title: How Norway Built a $1.3 Trillion Oil Fund - Joe Rogan

Channel: Wealth Herd

URL: https://www.youtube.com/watch?v=2QaURhJF5AQ

Published: 3 months ago

News