Netflix Q3 2025 Earnings Miss Due to Brazil Tax Dispute, Focus on Ads and Content Growth

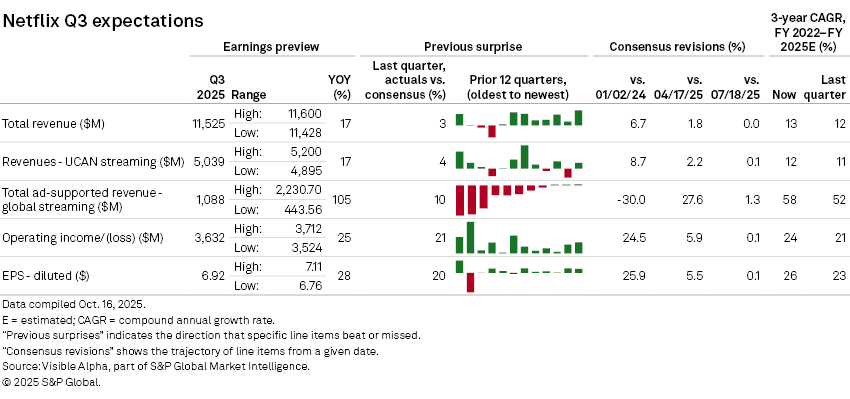

Netflix's Q3 2025 earnings missed Wall Street expectations mainly due to an unexpected $619 million tax charge from a dispute with Brazilian authorities, leading to a reduced operating margin of 28%. Despite this, revenue grew 17% to $11.51 billion, aligning with forecasts. The tax issue notably lowered adjusted earnings per share to $5.87 versus the expected $6.97, highlighting the complexities of Netflix’s international expansion. Strategically, Netflix is focusing on growing advertising revenue, aiming to more than double it in 2025 by adopting a hybrid subscription and ad model. The company also continues heavy investment in original content to stay competitive against rivals like YouTube and Disney+. Successfully navigating international regulatory challenges and maintaining strong content offerings will be crucial to Netflix’s sustained growth and stock performance.

Summary

Netflix Q3 2025 Earnings Miss Amid Brazil Tax Dispute, Advertising and Content Strategies Key to Future Outlook

Netflix's third-quarter earnings for 2025 fell short of Wall Street estimates, primarily driven by an unexpected $619 million tax expense linked to a dispute with Brazilian tax authorities. This unforeseen charge contributed to a reduced operating margin of 28% for the quarter, highlighting significant international regulatory challenges for the streaming giant. However, despite these setbacks, Netflix posted a solid 17% revenue increase to $11.51 billion, in line with analyst forecasts, demonstrating resilience in a competitive streaming market.

Impact of Brazil Tax Dispute on Financial Results

The principal factor behind Netflix’s earnings miss was the sizable tax liability imposed by Brazilian authorities over payments made within the country. This issue notably weighed on adjusted earnings per share, which came in at $5.87, below the expected $6.97. The Brazilian tax dispute exemplifies the complex international regulatory environment Netflix faces and underscores the financial risks associated with expanding its global footprint.

Strategic Focus on Advertising Revenue Growth

In response to evolving market dynamics, Netflix has shifted focus towards expanding advertising revenue streams. Although the company no longer reports exact subscriber numbers, it confirmed ongoing subscriber growth as it increasingly adopts a hybrid monetization model combining subscription fees with advertisements. Netflix aims to more than double its advertising revenue in 2025, signaling a critical component of its financial strategy to offset pressures from tax disputes and maintain revenue momentum.

Content Investment Amidst Streaming Market Competition

Netflix continues to prioritize distinctive original content, investing heavily in television series and films designed to differentiate its platform from competitors such as YouTube, Amazon Prime Video, and Disney+. Maintaining a compelling content library is essential for subscriber retention and engagement, especially as competition intensifies in the global streaming market.

Navigating International Regulatory Risks

The tax dispute in Brazil highlights broader international regulatory risks that can affect Netflix’s operating margins and stock performance. Effective management of such disputes and compliance with diverse tax regimes will be crucial for stabilizing financial results and supporting investor confidence.

Conclusion

Netflix’s Q3 2025 earnings shortfall driven by the Brazil tax dispute reflects the challenges of operating in a complex international environment. Despite this, the company’s consistent revenue growth, strategic emphasis on advertising revenue expansion, and robust content investments position it well for sustained long-term growth. Managing international regulatory challenges alongside competitive content offerings will be key determinants of Netflix’s future stock outlook and overall market success.

Frequently Asked Questions

Q: Netflix stock price impact Brazil tax dispute

A: Netflix's stock price can be influenced by news of tax disputes in Brazil, as such issues may affect the company's financial performance and investor confidence. If Brazil imposes significant taxes or penalties, it could lead to increased operational costs for Netflix, potentially reducing profits. Investors often react to such regulatory challenges by adjusting their outlook on the company's growth prospects in the region, which can cause stock price fluctuations. However, the exact impact depends on the dispute's scale and Netflix's broader financial health.

Q: Netflix Q3 2025 earnings report

A: Netflix's Q3 2025 earnings report is expected to provide detailed financial results for the third quarter, including revenue, net income, subscriber growth, and other key performance indicators. The report will likely highlight how the company is performing amid competition and market trends, as well as any strategic initiatives or content investments. Investors and analysts typically look for updates on subscriber numbers and revenue to gauge Netflix's continued growth and profitability.

Q: Netflix subscriber growth Asia-Pacific

A: Netflix has experienced significant subscriber growth in the Asia-Pacific region, driven by increasing internet penetration and rising demand for diverse streaming content. The company has invested in local-language productions and tailored content to appeal to regional audiences. Despite strong competition from other streaming services, Netflix's focus on original content and strategic partnerships has helped expand its subscriber base across key markets such as India, Japan, and Southeast Asia.

Q: Netflix advertising revenue performance

A: Netflix introduced an ad-supported subscription tier in late 2022, marking its entry into the advertising market. Since then, the company has seen steady growth in advertising revenue as it attracts advertisers targeting its large global subscriber base. While Netflix's ad revenue is still a small portion of its overall earnings compared to traditional subscription fees, it is expected to become a significant contributor as the ad-supported model expands. Market analysts view Netflix's advertising performance positively, noting its potential to diversify revenue streams amid increased competition.

Q: Netflix future content releases 2025

A: Netflix has announced a diverse slate of content planned for release in 2025, including new original series, films, and documentaries across various genres. The platform continues to invest heavily in international productions and high-profile franchises to expand its global audience. While specific titles and dates may be announced closer to release, Netflix typically reveals its upcoming lineup through press releases and its official social media channels throughout the year.

Key Entities

Netflix: Netflix is a global streaming service offering a wide range of films and TV shows to subscribers in multiple countries. It has become a dominant player in the entertainment industry by investing heavily in original content and expanding its international market, including Brazil.

Brazil: Brazil is the largest country in South America known for its diverse culture and significant media market. It represents a key growth region for global streaming platforms like Netflix, contributing substantially to their subscriber base.

Greg Peters: Greg Peters is the CEO of Netflix, responsible for overseeing its strategic direction and operations. He plays a key role in guiding the company through evolving market challenges and expanding its global reach.

Ross Benes: Ross Benes is a senior analyst at Morningstar specializing in media and entertainment. He offers insights into Netflix's business model and competitive positioning in the streaming market.

Morningstar: Morningstar is a financial services firm that provides investment research and analysis. It is recognized for its thorough evaluations of companies like Netflix within various industries.

External articles

- Netflix blames $600m tax dispute with Brazil for ...

- Netflix shares drop as Brazilian tax dispute hits earnings

- Netflix Says Tax Dispute Hurt Solid Quarter; Shares Tumble

Articles in same category

- Bitcoin Core v30 Update Expands OP_RETURN Data Capacity Amid Community Debate

- China’s Rare Earth Export Controls Escalate US-China Trade War and Impact Crypto Markets

- OpenAI's Trillion Dollar AI Investment Strategy for Market Leadership

YouTube Video

Title: Netflix misses earnings estimates, citing Brazilian tax dispute

URL: https://www.youtube.com/shorts/tZvxM2I4Dao

Crypto