HKEX Tightens Rules on Corporate Crypto Holdings to Ensure Market Integrity

Hong Kong Exchanges and Clearing (HKEX) has tightened regulations on companies holding significant cryptocurrency assets in their treasuries, challenging digital asset treasury (DAT) models that treat crypto holdings as core balance sheet assets. HKEX now requires listed firms to maintain substantial non-crypto business activities unless cryptocurrency is essential to their operations, prohibiting excessive crypto asset accumulation without operational justification. This move reflects a cautious regulatory stance aimed at preventing speculative crypto hoarding disguised as business activity. Across Asia-Pacific, stock exchanges exhibit varying approaches—from HKEX’s strict limits to Japan’s more permissive attitude—highlighting a regional effort to balance innovation with market integrity and investor protection in the evolving corporate crypto landscape.

Summary

HKEX Tightens Regulations on Corporate Crypto Holdings Amid Growing Regional Scrutiny

Hong Kong Exchanges and Clearing (HKEX) has introduced more stringent listing rules targeting companies that hold significant cryptocurrency assets in their treasury. This move specifically challenges digital asset treasury (DAT) models, where firms accumulate substantial cryptocurrencies such as Bitcoin as part of their balance sheets. HKEX’s regulatory push underscores the importance of sustainable business operations beyond crypto holdings, aiming to curtail speculative treasury hoarding disguised as legitimate business activity.

HKEX’s New Stance on Digital Asset Treasury Models

HKEX mandates that listed companies must maintain viable and substantive core business activities unrelated to crypto asset accumulation unless cryptocurrency forms an essential business component. Companies are now prohibited from holding excessive liquid assets, especially cryptocurrencies, if such holdings are not justified by operational necessity. This rigorous enforcement has led HKEX to question at least five companies over their cryptocurrency acquisition plans, reinforcing compliance with existing listing regulations and preserving market integrity.

Asia-Pacific Stock Exchanges: Divergent Approaches to Cryptocurrency Regulation

The regulatory landscape across Asia-Pacific stock exchanges reflects a spectrum of approaches toward corporate crypto holdings:

- Hong Kong Exchanges and Clearing (HKEX): Leading in strictness, HKEX enforces clear limitations on digital asset treasuries and requires demonstrable business operations supporting crypto-related activities.

- Bombay Stock Exchange (BSE), India: Exhibits skepticism by rejecting applications from companies with aggressive crypto investment plans, underscoring cautious cryptocurrency regulation.

- Australian Stock Exchange (ASX): Imposes indirect limits on crypto hoarding by restricting companies from holding over 50% of their assets in cash or cash-like instruments, which effectively limits excessive digital asset holdings.

- Japan’s Stock Exchanges: Adopts a more permissive approach, allowing some digital asset treasury strategies with minimal regulatory resistance, signaling a relatively open stance on corporate crypto adoption.

Balancing Innovation with Market Integrity

The varied policies across the region illustrate a broader trend of institutional maturity in managing corporate cryptocurrency holdings and associated market risks. Regulators prioritize investor protection and market stability by avoiding unchecked speculative treasury hoarding. The emphasis remains on preventing firms from using their balance sheets for speculative accumulation of cryptocurrencies unrelated to core business functions.

Conclusion

HKEX’s enforcement of stricter listing rules on crypto asset treasuries signals a significant shift toward more disciplined cryptocurrency regulation in Asia-Pacific’s capital markets. By requiring viable business models beyond digital asset holdings and scrutinizing potential speculative behaviors, HKEX leads a cautious yet progressive regulatory phase. This approach, mirrored by other regional exchanges albeit with varying degrees, represents a vital balance between fostering financial innovation and ensuring market integrity and investor protection amid the evolving corporate cryptocurrency landscape.

Frequently Asked Questions

Q: Hong Kong Stock Exchange crypto regulations

A: The Hong Kong Stock Exchange (HKEX) has taken a cautious approach to cryptocurrencies, focusing on regulatory compliance and investor protection. While it does not currently list cryptocurrency assets directly, HKEX oversees companies involved in crypto-related activities and ensures they adhere to existing securities laws. The Hong Kong Securities and Futures Commission (SFC) has implemented guidelines requiring licensing for virtual asset trading platforms and mandates strict anti-money laundering controls. Overall, HKEX's framework aims to balance innovation with risk management in the rapidly evolving crypto space.

Q: What is Digital Asset Treasury

A: Digital Asset Treasury refers to the management and oversight of a company's or organization's holdings in digital assets such as cryptocurrencies, tokens, and other blockchain-based assets. It involves strategies for acquisition, storage, risk management, liquidity, and compliance related to these assets. The goal is to optimize financial performance while ensuring security and regulatory adherence in the rapidly evolving digital asset landscape.

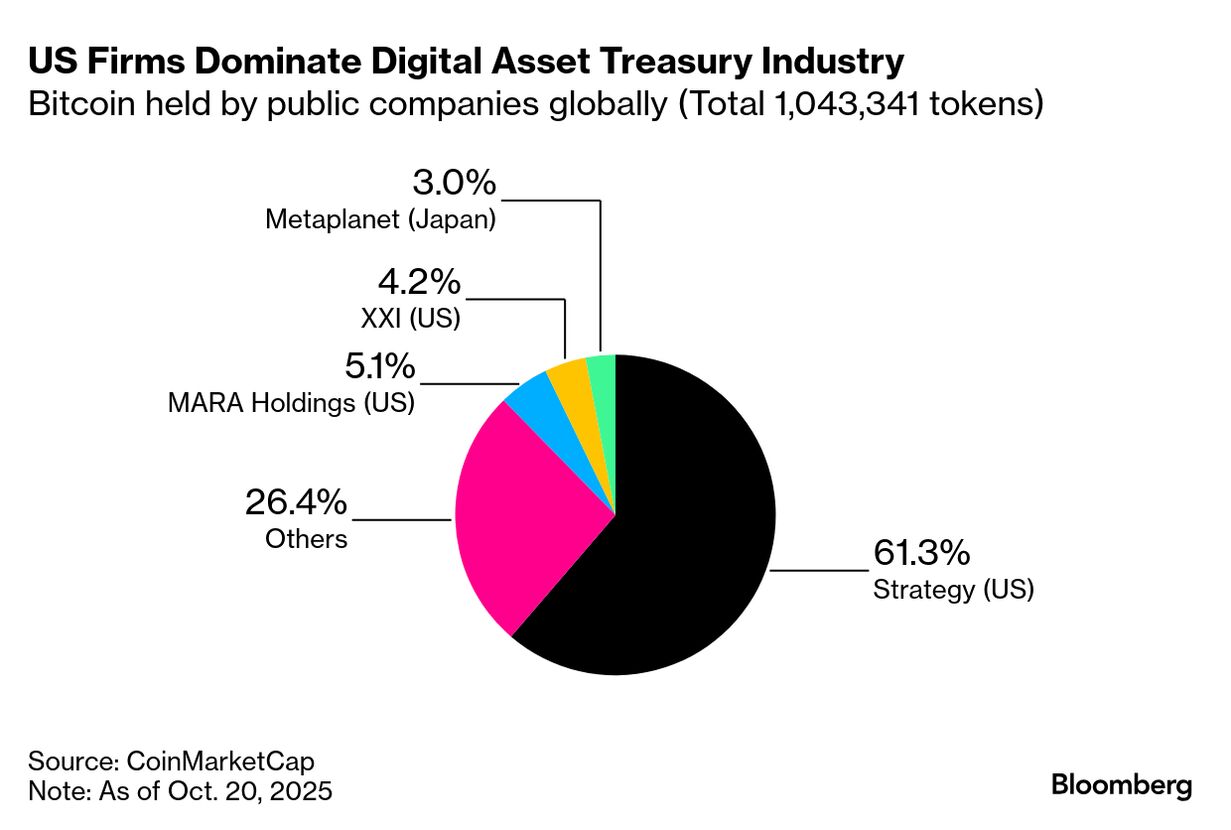

Q: Companies holding Bitcoin treasuries

A: Several publicly traded companies have incorporated Bitcoin into their treasury reserves as a strategic asset. Notable examples include MicroStrategy, which has accumulated significant Bitcoin holdings, and Tesla, which purchased Bitcoin for its corporate treasury in early 2021. Other companies like Square (now Block) have also invested in Bitcoin, using it both as a reserve asset and to support their business models centered around digital currencies. These corporate Bitcoin treasuries are seen as a hedge against inflation and a way to diversify their balance sheets.

Q: Regulations on crypto hoarding companies

A: Regulations on companies that accumulate and hold large amounts of cryptocurrency, often referred to as 'crypto hoarding,' vary by jurisdiction but generally focus on transparency, reporting, and anti-money laundering measures. Many countries require these companies to comply with financial regulations, including Know Your Customer (KYC) rules and periodic disclosures to tax authorities. Regulators are increasingly scrutinizing firms hoarding crypto assets to prevent market manipulation, ensure tax compliance, and protect investors from excessive risk concentration. Compliance with these regulations helps maintain market stability and investor confidence.

Q: Impact of crypto rules on stock listings

A: Crypto regulations can significantly influence stock listings, particularly for companies involved in cryptocurrency or blockchain sectors. Stricter rules may impose disclosure requirements, compliance costs, or limit the types of crypto assets a company can hold or trade, potentially affecting investor confidence and stock demand. Conversely, clear and supportive regulations can enhance market transparency and attract more listings from crypto-related firms, boosting stock market activity. Overall, the impact depends on the nature and enforcement of the crypto rules in a given jurisdiction.

Key Entities

Hong Kong Stock Exchange: The Hong Kong Stock Exchange is one of the largest stock markets in Asia, serving as a crucial financial hub for international and Chinese companies. It plays a significant role in global finance by facilitating access to capital for diverse sectors and supporting economic growth in the region.

MicroStrategy: MicroStrategy is a business intelligence company known for its enterprise analytics software and early adoption of Bitcoin as a treasury reserve asset. It has influenced the integration of blockchain technology in corporate finance and data analytics.

Simon Hawkins: Simon Hawkins is a business executive involved in technology and corporate leadership roles. He has contributed to strategic initiatives linking tech innovation with market expansion, often appearing in discussions about digital transformation.

Kevin de Patoul: Kevin de Patoul is recognized for his expertise in finance and investment management, focusing on corporate strategy and market analysis. His professional insights contribute to understanding financial markets and investment trends.

Jetking Infotrain: Jetking Infotrain is an Indian IT training institute specializing in hardware and networking education. It is known for providing skill development programs aimed at enhancing employability in the technology sector.

External articles

- Hong Kong Stock Exchange Tightens Scrutiny on Crypto ...

- Asia's Biggest Stock Exchanges Push Back Against ...

- Hong Kong Stock Exchange Responds to Reports on ...

Articles in same category

- Bitcoin Core v30 Update Expands OP_RETURN Data Capacity Amid Community Debate

- China’s Rare Earth Export Controls Escalate US-China Trade War and Impact Crypto Markets

- OpenAI's Trillion Dollar AI Investment Strategy for Market Leadership

YouTube Video

Title: Asia’s biggest exchanges are pushing back on crypto treasury applications. Is this the end of shell

URL: https://www.youtube.com/shorts/f5ep5Hp5q8E

Crypto