ASIC Expands Financial Services Regulation to Stablecoins and Tokenized Assets in Australia

Australia’s financial regulator, ASIC, has expanded its regulatory framework to classify stablecoins and tokenized assets as financial products, requiring providers to obtain an Australian Financial Services Licence (AFSL). The updated rules broaden ASIC’s oversight to include various digital assets like wrapped tokens, staking services, and tokenized securities, applying also to offshore and decentralized platforms serving Australian users. To ease the transition, ASIC has introduced a temporary no-action position until June 30, 2026, allowing firms time to comply without immediate enforcement. Additionally, relief measures grant certain licensing and disclosure exemptions to distributors under specific conditions. Enhanced guidance with 18 examples clarifies the regulatory scope. This comprehensive framework aims to balance innovation and investor protection, reinforcing Australia’s position as a forward-looking jurisdiction in digital asset regulation.

Summary

ASIC Expands Financial Services Regulation to Stablecoins and Tokenized Assets in Australia

Australia’s financial regulator, the Australian Securities and Investments Commission (ASIC), has updated its regulatory framework to classify stablecoins and tokenized assets as financial products. This significant change requires providers operating in this sector to obtain an Australian Financial Services Licence (AFSL) to ensure legal compliance, consumer protection, and effective regulatory enforcement.

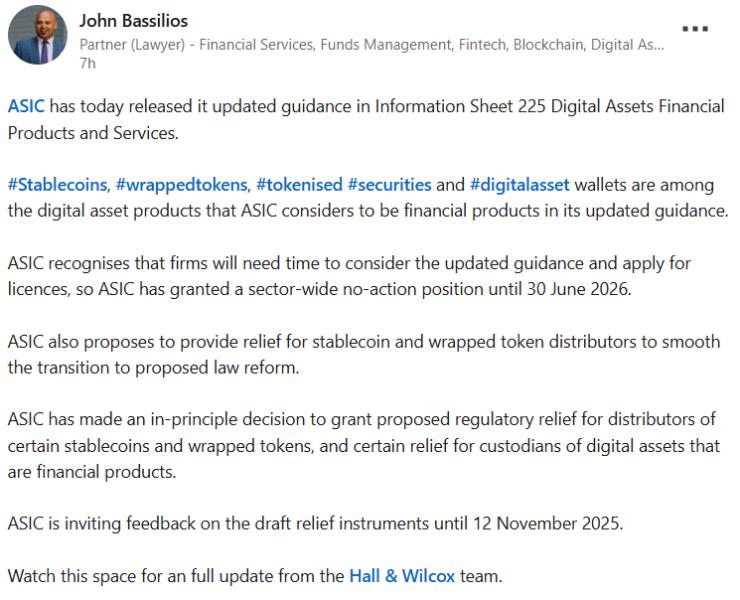

Extended Regulatory Scope for Digital Assets

The updated framework broadens the definition of financial services under ASIC’s mandate to include a wide array of digital asset categories. These now explicitly encompass stablecoins, wrapped tokens, staking services, and tokenized securities. Moreover, ASIC clarified that its regulatory oversight applies to offshore and decentralized platforms servicing Australian users, closing prior gaps in jurisdictional authority.

Temporary No-Action Position to Facilitate Industry Adaptation

Recognizing the transitional challenges faced by digital asset providers, ASIC has introduced a temporary no-action position, effective until June 30, 2026. This measure offers firms a grace period to align their operations with the AFSL requirements without immediate enforcement action, providing them time to apply for licenses while ensuring ongoing consumer safeguards.

Relief Instrument for Licensing and Disclosure Exemptions

Alongside the no-action position, ASIC has implemented a relief instrument that grants specific licensing and disclosure exemptions to distributors—those who do not issue stablecoins or wrapped tokens themselves. These exemptions hinge on conditions related to redemption rights and the maintenance of adequate reserves, ensuring that key investor protection principles remain intact despite the eased requirements.

Enhanced Guidance with Digital Asset Examples

To better delineate the scope of regulated digital assets, ASIC has expanded its Info Sheet 225 to include 18 illustrative examples covering diverse digital asset forms such as tokenized real estate, gaming NFTs, and yield-bearing stablecoins. This expanded guidance clarifies regulatory expectations and helps industry participants better understand how current financial product laws apply to emerging digital innovations.

Balancing Innovation and Investor Protection

ASIC’s comprehensive framework reflects a commitment to balancing the need for investor protection with fostering innovation within Australia’s rapidly growing digital asset market. By aligning regulatory requirements with emerging technologies and the realities of crypto adoption, the framework supports the integrity and stability of financial services while encouraging responsible development in decentralized platforms and offshore operators.

Conclusion

ASIC’s updated regulations mark a pivotal step in integrating stablecoins and tokenized assets into Australia’s financial regulatory landscape. The requirement for an AFSL, supported by transitional relief measures and enhanced guidance, helps ensure that providers of wrapped tokens, staking services, and related digital assets operate transparently and within a robust legal framework. These changes provide clarity for market participants and reinforce consumer safeguards amid expanding crypto usage, positioning Australia as a forward-looking jurisdiction in digital asset regulation.

Frequently Asked Questions

Q: Are stablecoins considered financial products in Australia?

A: In Australia, whether stablecoins are considered financial products depends on their specific characteristics and how they are used. The Australian Securities and Investments Commission (ASIC) assesses stablecoins case-by-case to determine if they meet the definition of a financial product under the Corporations Act. Generally, if a stablecoin provides rights or interests similar to traditional financial products, such as managed investment schemes or derivatives, it may be regulated as a financial product. However, stablecoins purely used as a means of payment may not fall under this classification. It's important for issuers and users to seek legal advice to understand regulatory obligations.

Q: What licensing is required for stablecoin providers in Australia?

A: Stablecoin providers in Australia are required to hold an Australian Financial Services Licence (AFSL) or operate under a relevant exemption, depending on the nature of their services. Additionally, if the stablecoin is considered a digital currency, providers must register with AUSTRAC as a digital currency exchange and comply with anti-money laundering and counter-terrorism financing (AML/CTF) obligations. Regulatory requirements may also vary based on whether the stablecoin is pegged to fiat currency or assets, so providers should seek legal advice to ensure full compliance.

Q: ASIC regulations on digital assets and stablecoins

A: The Australian Securities and Investments Commission (ASIC) regulates digital assets and stablecoins under existing financial laws to ensure investor protection and market integrity. ASIC requires entities dealing with digital assets to hold appropriate licenses, comply with anti-money laundering (AML) and counter-terrorism financing (CTF) obligations, and provide clear disclosure to consumers. For stablecoins, ASIC assesses whether they fall within the definition of financial products or securities, which would bring additional regulatory requirements. Overall, ASIC aims to balance innovation in digital finance with safeguarding the market and consumers.

Q: How will new Australian laws affect crypto exchanges?

A: New Australian laws aim to increase regulation and oversight of crypto exchanges to enhance consumer protection and reduce illegal activities such as money laundering. Exchanges may face stricter licensing requirements, mandatory reporting obligations, and must comply with anti-money laundering (AML) and counter-terrorism financing (CTF) rules. These changes could increase operational costs but also build greater trust in the crypto market. Overall, the laws seek to create a safer and more transparent environment for cryptocurrency trading in Australia.

Q: Australia stablecoin regulation transition period

A: Australia is implementing a regulatory framework for stablecoins to ensure consumer protection and financial stability. To facilitate this, authorities have introduced a transition period during which existing stablecoin issuers must comply with new licensing and operational requirements. This transition period allows issuers time to adapt their systems and processes to meet regulatory standards without disrupting market activity. The exact duration of the transition period is defined by the Australian Treasury and regulatory bodies, aiming to balance industry readiness with effective oversight.

Key Entities

Australian Securities and Investments Commission: The Australian Securities and Investments Commission (ASIC) is the regulator responsible for enforcing company and financial services laws to protect consumers and investors in Australia. ASIC oversees activities such as licensing, market integrity, and compliance, ensuring transparency in the Australian financial sector.

Alan Kirkland: Alan Kirkland is the founder and CEO of Catena Digital Pty Ltd, a company specializing in digital asset management and cryptocurrency services. He has played a significant role in advancing blockchain technology adoption within the Australian financial market.

Catena Digital Pty Ltd: Catena Digital Pty Ltd is an Australian company focused on blockchain infrastructure and cryptocurrency services. It provides digital asset solutions and aims to support the growth of decentralized finance in Australia.

Coinbase: Coinbase is a leading global cryptocurrency exchange that enables users to buy, sell, and store digital assets. It is widely recognized for its user-friendly platform and regulatory compliance efforts across multiple jurisdictions.

Kraken: Kraken is a prominent cryptocurrency exchange known for robust security measures and a wide range of digital asset trading options. The platform serves customers globally and is one of the oldest exchanges in the industry.

External articles

- Updated ASIC guidance supports digital asset innovation ...

- Australian Regulator Clarifies Digital Asset Rules, Grants ...

- Australia classifies stablecoins, wrapped tokens as ...

Articles in same category

- Bitcoin Core v30 Update Expands OP_RETURN Data Capacity Amid Community Debate

- China’s Rare Earth Export Controls Escalate US-China Trade War and Impact Crypto Markets

- OpenAI's Trillion Dollar AI Investment Strategy for Market Leadership

YouTube Video

Title: Australia Might Reclassify Stablecoins as Financial Products

Channel: Crypto World Daily

URL: https://www.youtube.com/watch?v=32WoqoBvIOE

Published: 55 minutes ago

Crypto